- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Why We're Not Concerned Yet About Envipco Holding N.V.'s (AMS:ENVI) 27% Share Price Plunge

Envipco Holding N.V. (AMS:ENVI) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

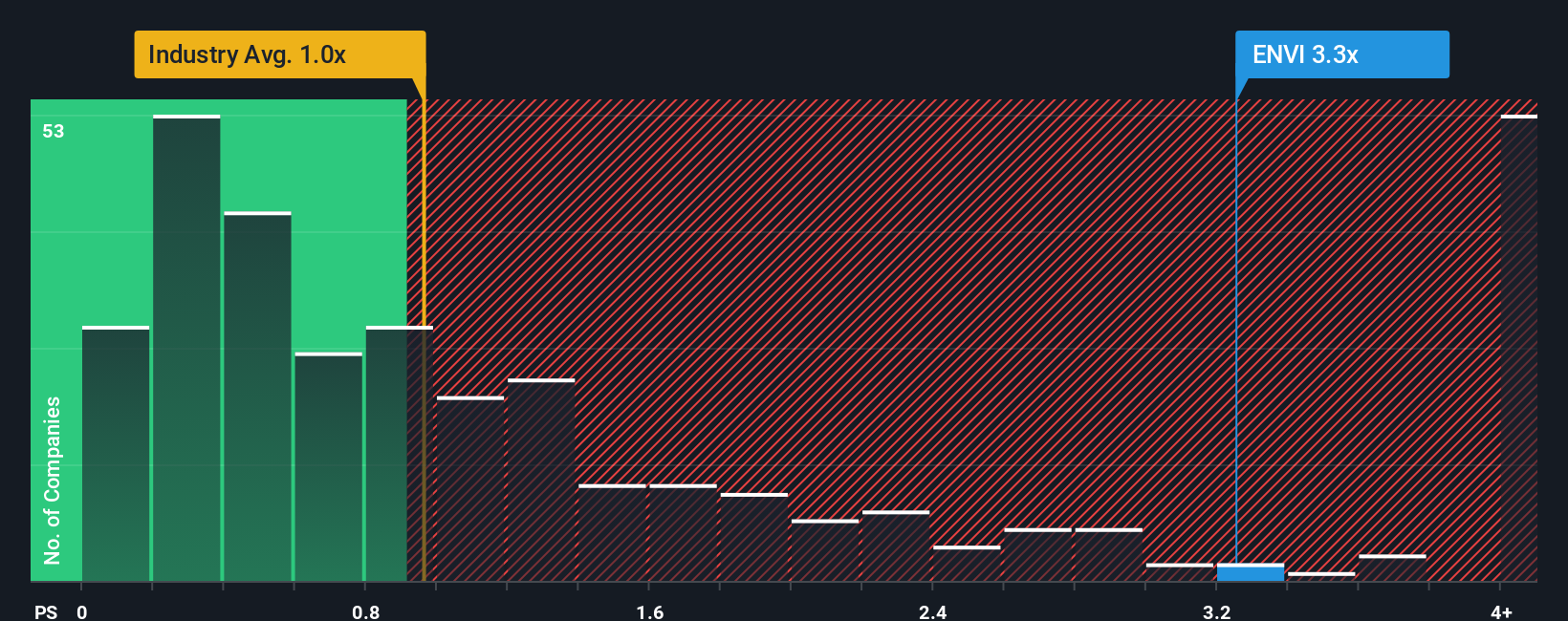

Even after such a large drop in price, you could still be forgiven for thinking Envipco Holding is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in the Netherlands' Machinery industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Envipco Holding

How Envipco Holding Has Been Performing

Envipco Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Envipco Holding.Is There Enough Revenue Growth Forecasted For Envipco Holding?

In order to justify its P/S ratio, Envipco Holding would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 9.3% decrease to the company's top line. Still, the latest three year period has seen an excellent 117% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 40% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 18% per annum growth forecast for the broader industry.

With this information, we can see why Envipco Holding is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Envipco Holding's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Envipco Holding maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Envipco Holding that you should be aware of.

If these risks are making you reconsider your opinion on Envipco Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ENVI

Envipco Holding

Develops, manufactures, assembles, leases, sells, markets, and services a line of reverse vending machines (RVMs) in the Netherlands, the United States, North America, and Europe.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives