- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

If You Had Bought Envipco Holding (AMS:ENVI) Stock A Year Ago, You Could Pocket A 10% Gain Today

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the Envipco Holding N.V. (AMS:ENVI) share price is up 10% in the last year, clearly besting the market decline of around 0.8% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Envipco Holding for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Envipco Holding

Envipco Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Envipco Holding saw its revenue shrink by 12%. The stock is up 10% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

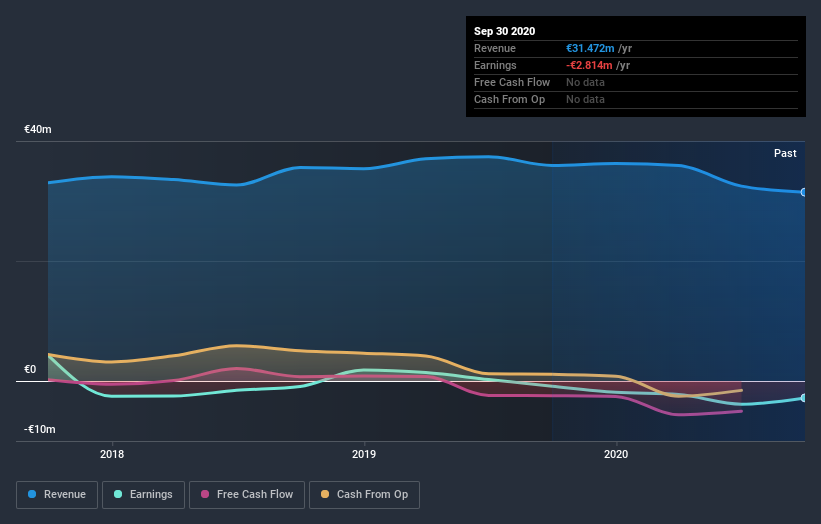

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Envipco Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Envipco Holding shareholders have gained 10% over the last year. And the share price momentum remains respectable, with a gain of 67% in the last three months. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Envipco Holding better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Envipco Holding you should be aware of, and 1 of them is significant.

Of course Envipco Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

If you decide to trade Envipco Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential with adequate balance sheet.