- Netherlands

- /

- Construction

- /

- ENXTAM:BAMNB

Why Investors Shouldn't Be Surprised By Koninklijke BAM Groep nv's (AMS:BAMNB) 30% Share Price Surge

Koninklijke BAM Groep nv (AMS:BAMNB) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 82%.

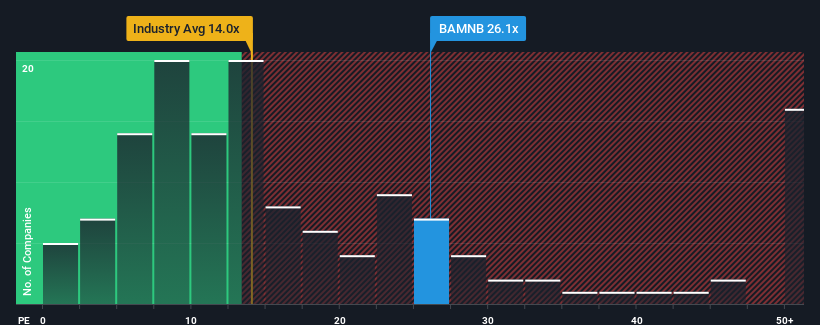

Since its price has surged higher, given around half the companies in the Netherlands have price-to-earnings ratios (or "P/E's") below 17x, you may consider Koninklijke BAM Groep as a stock to potentially avoid with its 26.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

While the market has experienced earnings growth lately, Koninklijke BAM Groep's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Koninklijke BAM Groep

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Koninklijke BAM Groep's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 64% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 256% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 56% per annum as estimated by the dual analysts watching the company. With the market only predicted to deliver 16% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Koninklijke BAM Groep's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Koninklijke BAM Groep's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Koninklijke BAM Groep's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Koninklijke BAM Groep that you should be aware of.

If you're unsure about the strength of Koninklijke BAM Groep's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke BAM Groep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:BAMNB

Koninklijke BAM Groep

Provides products and services in the construction and property, civil engineering, and public private partnerships (PPP) sectors worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives