- Netherlands

- /

- Construction

- /

- ENXTAM:BAMNB

Koninklijke BAM Groep nv's (AMS:BAMNB) Price Is Right But Growth Is Lacking After Shares Rocket 25%

Koninklijke BAM Groep nv (AMS:BAMNB) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last month tops off a massive increase of 130% in the last year.

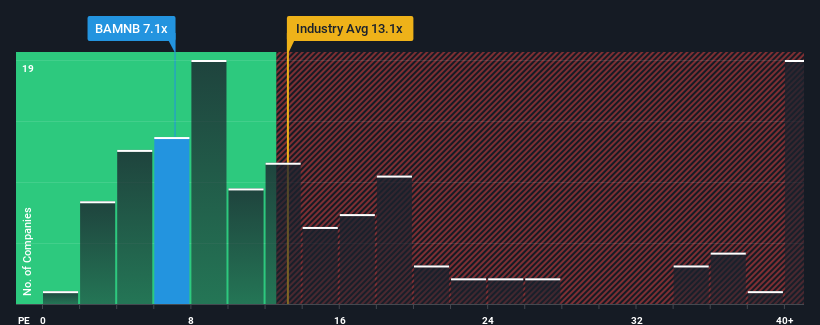

Although its price has surged higher, Koninklijke BAM Groep may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.1x, since almost half of all companies in the Netherlands have P/E ratios greater than 19x and even P/E's higher than 36x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Koninklijke BAM Groep's earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Koninklijke BAM Groep

How Is Koninklijke BAM Groep's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Koninklijke BAM Groep's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. The latest three year period has also seen an excellent 2,413% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 5.4% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is noticeably more attractive.

In light of this, it's understandable that Koninklijke BAM Groep's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Koninklijke BAM Groep's P/E?

Shares in Koninklijke BAM Groep are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Koninklijke BAM Groep maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Koninklijke BAM Groep (1 shouldn't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke BAM Groep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:BAMNB

Koninklijke BAM Groep

Provides products and services in the construction and property, civil engineering, and public private partnerships (PPP) sectors worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives