- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

ING (ENXTAM:INGA) Valuation: Assessing Whether Recent Gains Reflect Full Growth Potential

Reviewed by Simply Wall St

ING Groep (ENXTAM:INGA) stock has logged steady gains over the past month, catching the interest of investors watching European banking trends. The company’s recent performance continues to reflect both sector dynamics and ongoing operational momentum.

See our latest analysis for ING Groep.

After a year marked by resilient progress, ING Groep’s share price has climbed 46% year-to-date, while its total shareholder return has soared nearly 59% over the past 12 months. The recent upward momentum suggests investors are warming to the group’s improving earnings outlook and consistent delivery. The latest 5.6% one-month share price return adds to already impressive long-term gains.

If you’re curious about what other stocks are gaining traction, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

The big question now is whether ING Groep’s rapid share price rise still leaves room for upside, or if recent gains mean markets are already factoring in all the future growth. Could there be further opportunity, or has value been priced in?

Most Popular Narrative: 20.5% Undervalued

ING Groep's current share price stands well below the narrative fair value, highlighting optimism that outpaces the latest market close. This sets the scene for a unique perspective on where ING's value may be headed next.

ING, of course, is a bank, and banks do not like falling interest rates, right? For the dominant stream of income is their core business model, that is, borrowing short-term and lending long-term, reaping the difference in interest rates in the process. This is known as the net-interest income (NII), a key performance indicator for banks and other financial operators.

Want to find out what ambitious profit margins and sector shifts could mean for ING’s future worth? There is a bold thesis here, built on a pivotal change in how the bank earns money and a fresh approach to forecasting its growth path. Discover the surprising engine that drives this valuation.

Result: Fair Value of $27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential rate cuts by the ECB or an unexpected slowdown in European infrastructure spending. Both of these factors could dampen future growth.

Find out about the key risks to this ING Groep narrative.

Another View: The Multiples Perspective

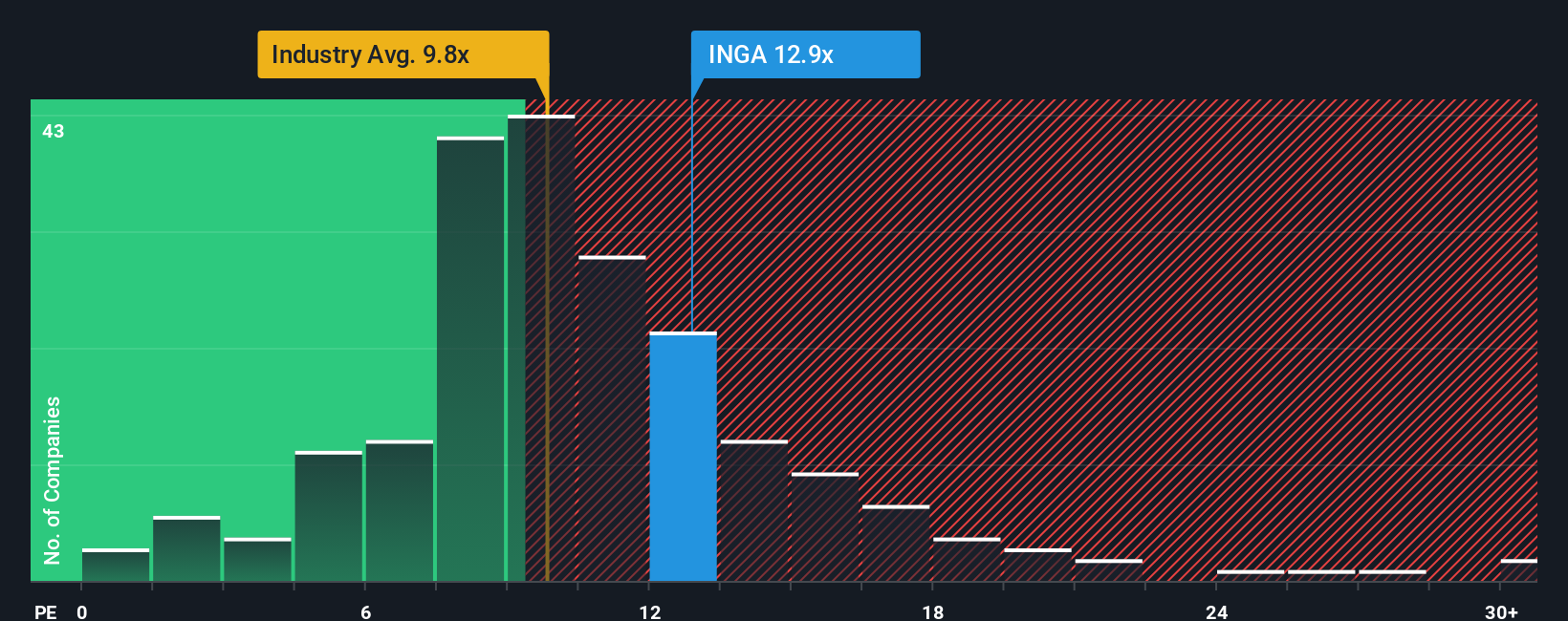

While our narrative-based fair value suggests significant upside, the standard price-to-earnings approach paints a more cautious picture. ING Groep’s current PE ratio of 12.9 is noticeably higher than both its peers (9.4) and the industry average (10.1), and it is also above the fair ratio (12.3). This hints at a premium price, raising questions about whether the market is now optimistic or just overconfident.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ING Groep Narrative

If you have a different take or want to dig deeper into the numbers, crafting your own view takes just a few minutes. Do it your way

A great starting point for your ING Groep research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take advantage of the latest market insights by targeting stocks with serious growth potential, unmatched innovation, or attractive income streams you won't want to overlook.

- Unlock potential for strong cash flow returns by checking out these 849 undervalued stocks based on cash flows to see which companies are trading below their estimated worth.

- Spot game-changing breakthroughs in medicine and technology when you access these 32 healthcare AI stocks, connecting you to firms at the forefront of healthcare advancements.

- Boost your portfolio’s income with stability by reviewing these 17 dividend stocks with yields > 3% for businesses offering yields above 3% that may enhance your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives