- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

Is ABN AMRO (ENXTAM:ABN) Facing a Prolonged Margin Squeeze Amid Consistent Earnings Pressure?

Reviewed by Sasha Jovanovic

- ABN AMRO Bank N.V. recently reported its earnings for the third quarter and first nine months of 2025, disclosing a decrease in both net interest income and net income compared to the prior year.

- This marks a consecutive period of lower basic earnings per share from continuing operations, signaling ongoing pressure on the bank’s profitability.

- We’ll explore how this continued earnings decline sharpens questions around ABN AMRO’s future profitability and margin sustainability.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

ABN AMRO Bank Investment Narrative Recap

To own ABN AMRO Bank stock, investors need to believe that the group’s focus on digital transformation, sustainable finance, and cost efficiency can stabilize earnings and safeguard margins, even as traditional banking faces long-term pressures. The latest earnings report’s drop in both net interest and net income heightens near-term concern about profitability, but does not materially impact the bank’s largest catalyst: the push to modernize its core banking offering and rebuild margin resilience. The main short-term risk remains that persistent regulatory headwinds and lagging fee income could further erode earnings.

Among recent developments, the EUR 250 million share buyback, completed shortly before the earnings release, stands out. While this move underscores management’s confidence in returning capital to shareholders, it also arrives at a moment when underlying earnings are increasingly under pressure, reinforcing the importance of balance sheet strength and ongoing cost discipline as catalysts for future margin recovery.

But against the promise of modernization and resilience, one risk that investors should keep front of mind is...

Read the full narrative on ABN AMRO Bank (it's free!)

ABN AMRO Bank's outlook forecasts €9.5 billion in revenue and €2.0 billion in earnings by 2028. This assumes annual revenue growth of 2.4%, but a decrease in earnings of €0.1 billion from the current €2.1 billion.

Uncover how ABN AMRO Bank's forecasts yield a €28.15 fair value, in line with its current price.

Exploring Other Perspectives

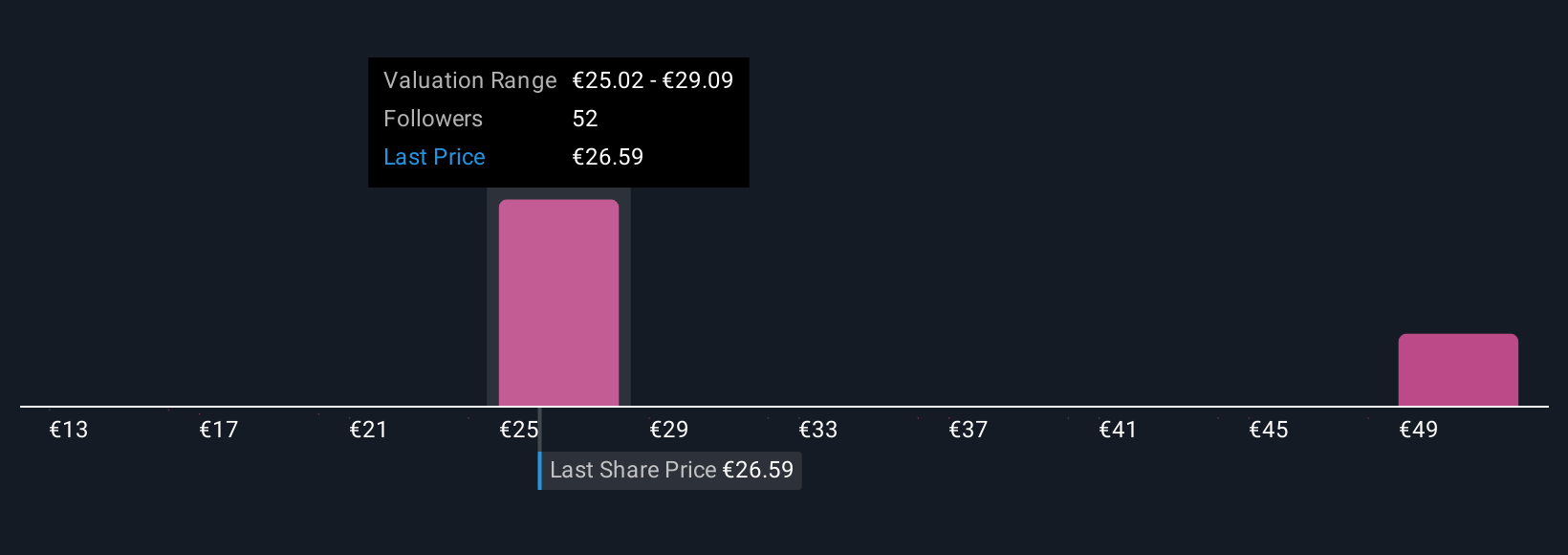

Seven private investors in the Simply Wall St Community pegged fair value for ABN AMRO Bank between €15 and €53.85, with the current share price at the lower end. While forecasts for digital growth drive optimism, persistent regulatory and fee income challenges mean opinions about future performance remain widely split, see how your outlook compares to others in the community.

Explore 7 other fair value estimates on ABN AMRO Bank - why the stock might be worth 47% less than the current price!

Build Your Own ABN AMRO Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABN AMRO Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ABN AMRO Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABN AMRO Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success