- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

If EPS Growth Is Important To You, ABN AMRO Bank (AMS:ABN) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like ABN AMRO Bank (AMS:ABN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for ABN AMRO Bank

How Fast Is ABN AMRO Bank Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that ABN AMRO Bank has grown EPS by 57% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

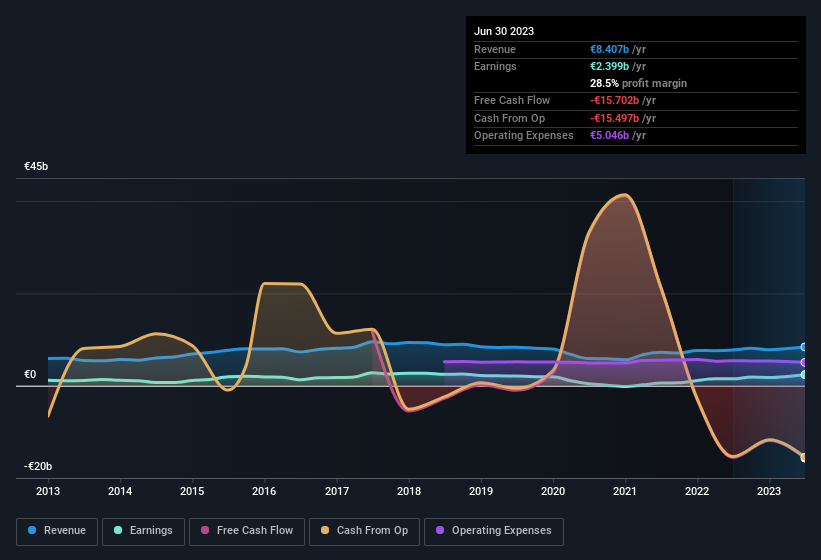

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of ABN AMRO Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for ABN AMRO Bank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 8.9% to €8.4b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of ABN AMRO Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are ABN AMRO Bank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, ABN AMRO Bank insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Chief Commercial Officer of Personal & Business Banking and Member of Executive Board, Annerie Vreugdenhil, paid €112k to buy shares at an average price of €11.21. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Recent insider purchases of ABN AMRO Bank stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations over €7.6b, like ABN AMRO Bank, the median CEO pay is around €3.2m.

The CEO of ABN AMRO Bank only received €1.0m in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is ABN AMRO Bank Worth Keeping An Eye On?

ABN AMRO Bank's earnings per share growth have been climbing higher at an appreciable rate. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests ABN AMRO Bank may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. Even so, be aware that ABN AMRO Bank is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of ABN AMRO Bank, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands and internationally.

Undervalued with excellent balance sheet and pays a dividend.