- Malaysia

- /

- Other Utilities

- /

- KLSE:YTLPOWR

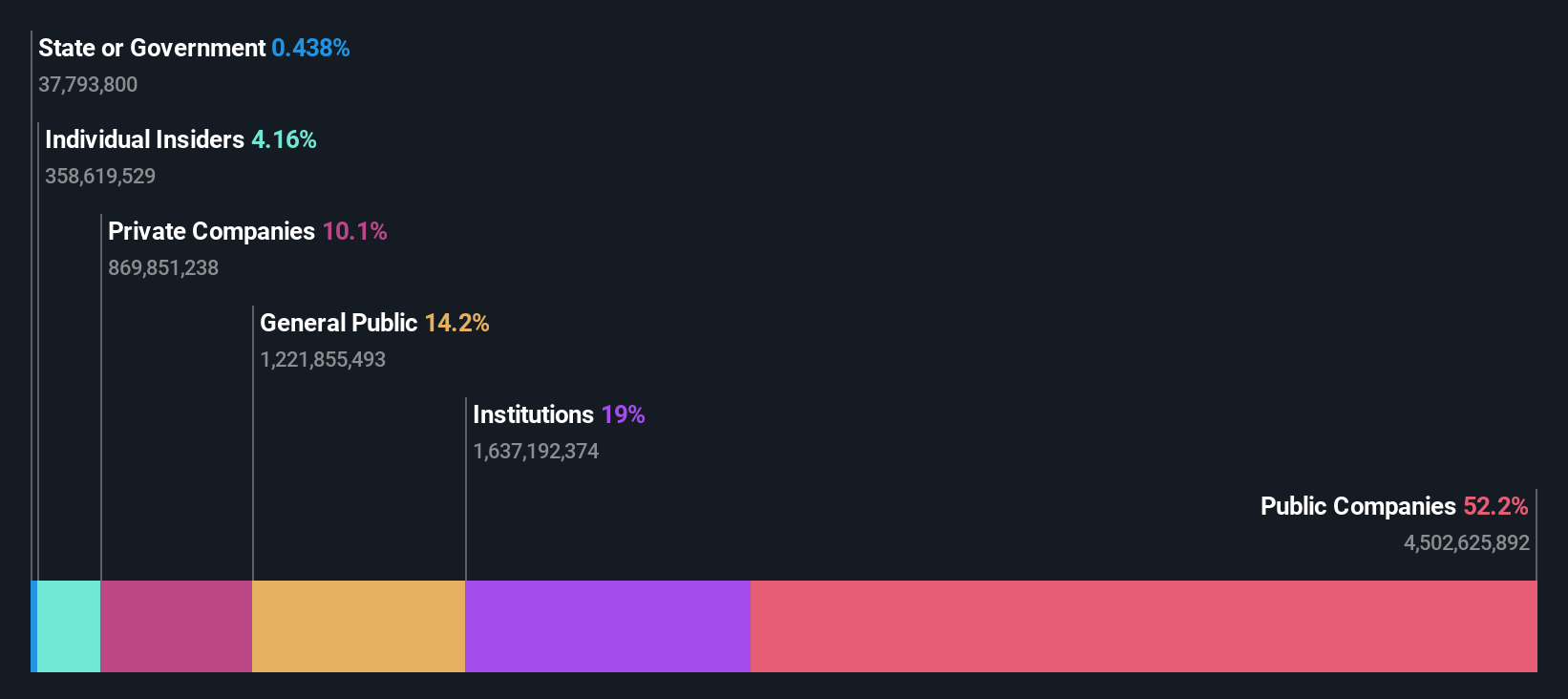

YTL Power International Berhad (KLSE:YTLPOWR) most popular amongst public companies who own 52% of the shares, institutions hold 19%

Key Insights

- YTL Power International Berhad's significant public companies ownership suggests that the key decisions are influenced by shareholders from the larger public

- YTL Corporation Berhad owns 52% of the company

- 19% of YTL Power International Berhad is held by Institutions

Every investor in YTL Power International Berhad (KLSE:YTLPOWR) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 52% to be precise, is public companies. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And institutions on the other hand have a 19% ownership in the company. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones.

Let's take a closer look to see what the different types of shareholders can tell us about YTL Power International Berhad.

View our latest analysis for YTL Power International Berhad

What Does The Institutional Ownership Tell Us About YTL Power International Berhad?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

As you can see, institutional investors have a fair amount of stake in YTL Power International Berhad. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see YTL Power International Berhad's historic earnings and revenue below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in YTL Power International Berhad. Our data shows that YTL Corporation Berhad is the largest shareholder with 52% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. For context, the second largest shareholder holds about 10% of the shares outstanding, followed by an ownership of 9.5% by the third-largest shareholder. In addition, we found that Seok Yeoh, the CEO has 2.0% of the shares allocated to their name.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of YTL Power International Berhad

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We can report that insiders do own shares in YTL Power International Berhad. The insiders have a meaningful stake worth RM1.2b. Most would see this as a real positive. Most would say this shows alignment of interests between shareholders and the board. Still, it might be worth checking if those insiders have been selling.

General Public Ownership

The general public, who are usually individual investors, hold a 14% stake in YTL Power International Berhad. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

We can see that Private Companies own 10%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

Public companies currently own 52% of YTL Power International Berhad stock. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for YTL Power International Berhad you should be aware of, and 1 of them is significant.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YTLPOWR

YTL Power International Berhad

An investment holding company, provides electricity, clean water, sewerage system, and telecommunication services in Malaysia, Singapore, the United Kingdom, and internationally.

Very undervalued with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion