- Malaysia

- /

- Electric Utilities

- /

- KLSE:TENAGA

Should You Be Adding Tenaga Nasional Berhad (KLSE:TENAGA) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Tenaga Nasional Berhad (KLSE:TENAGA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Tenaga Nasional Berhad with the means to add long-term value to shareholders.

Our free stock report includes 2 warning signs investors should be aware of before investing in Tenaga Nasional Berhad. Read for free now.How Fast Is Tenaga Nasional Berhad Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Tenaga Nasional Berhad managed to grow EPS by 8.0% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

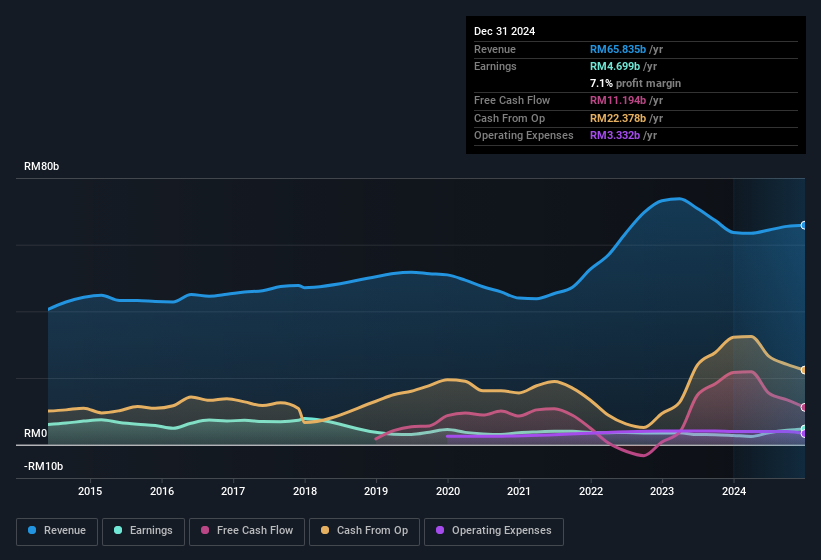

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Tenaga Nasional Berhad's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Tenaga Nasional Berhad remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.4% to RM66b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for Tenaga Nasional Berhad

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Tenaga Nasional Berhad.

Are Tenaga Nasional Berhad Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Tenaga Nasional Berhad, with market caps over RM35b, is about RM6.2m.

The Tenaga Nasional Berhad CEO received RM3.1m in compensation for the year ending December 2024. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Tenaga Nasional Berhad Worth Keeping An Eye On?

One important encouraging feature of Tenaga Nasional Berhad is that it is growing profits. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. All things considered, Tenaga Nasional Berhad is definitely worth taking a deeper dive into. Even so, be aware that Tenaga Nasional Berhad is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Although Tenaga Nasional Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tenaga Nasional Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TENAGA

Tenaga Nasional Berhad

Engages in the generation, transmission, distribution, and sale of electricity in Malaysia, the United Kingdom, Kuwait, the Republic of Ireland, Australia, and internationally.

Proven track record average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)