- Malaysia

- /

- Water Utilities

- /

- KLSE:PUNCAK

Puncak Niaga Holdings Berhad (KLSE:PUNCAK) Has No Shortage Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Puncak Niaga Holdings Berhad (KLSE:PUNCAK) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Puncak Niaga Holdings Berhad

What Is Puncak Niaga Holdings Berhad's Debt?

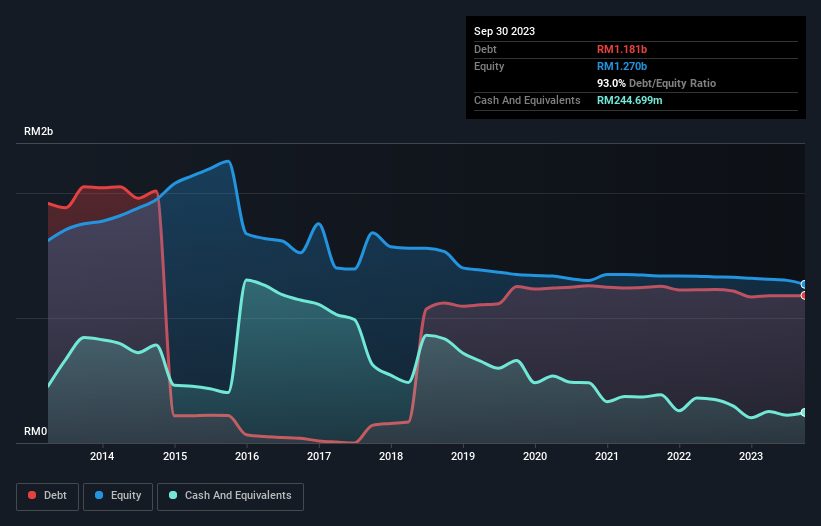

The chart below, which you can click on for greater detail, shows that Puncak Niaga Holdings Berhad had RM1.18b in debt in September 2023; about the same as the year before. However, it does have RM244.7m in cash offsetting this, leading to net debt of about RM936.3m.

How Healthy Is Puncak Niaga Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that Puncak Niaga Holdings Berhad had liabilities of RM481.4m falling due within a year, and liabilities of RM1.22b due beyond that. On the other hand, it had cash of RM244.7m and RM257.4m worth of receivables due within a year. So its liabilities total RM1.20b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM178.9m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Puncak Niaga Holdings Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 0.63 times and a disturbingly high net debt to EBITDA ratio of 15.7 hit our confidence in Puncak Niaga Holdings Berhad like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Worse, Puncak Niaga Holdings Berhad's EBIT was down 46% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Puncak Niaga Holdings Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Puncak Niaga Holdings Berhad recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Puncak Niaga Holdings Berhad's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least its conversion of EBIT to free cash flow is not so bad. It's also worth noting that Puncak Niaga Holdings Berhad is in the Water Utilities industry, which is often considered to be quite defensive. Taking into account all the aforementioned factors, it looks like Puncak Niaga Holdings Berhad has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Puncak Niaga Holdings Berhad , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PUNCAK

Puncak Niaga Holdings Berhad

An investment holding company, provides integrated water, wastewater, and environmental solutions in Malaysia.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026