- Malaysia

- /

- Transportation

- /

- KLSE:XINHWA

Xin Hwa Holdings Berhad (KLSE:XINHWA) Doing What It Can To Lift Shares

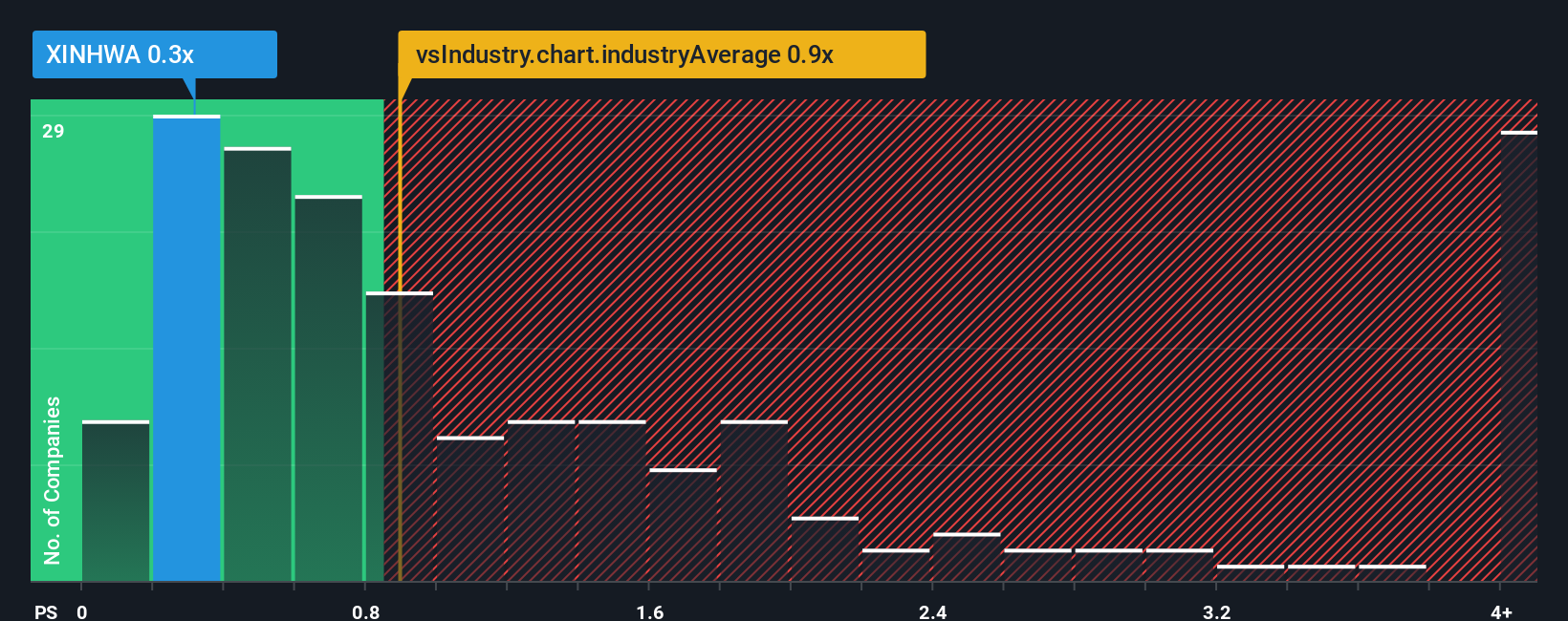

Xin Hwa Holdings Berhad's (KLSE:XINHWA) price-to-sales (or "P/S") ratio of 0.3x may look like a very appealing investment opportunity when you consider close to half the companies in the Transportation industry in Malaysia have P/S ratios greater than 2.7x. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Xin Hwa Holdings Berhad

What Does Xin Hwa Holdings Berhad's Recent Performance Look Like?

Revenue has risen firmly for Xin Hwa Holdings Berhad recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xin Hwa Holdings Berhad's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Xin Hwa Holdings Berhad?

Xin Hwa Holdings Berhad's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen an excellent 35% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 3.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Xin Hwa Holdings Berhad is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Xin Hwa Holdings Berhad's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Xin Hwa Holdings Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Xin Hwa Holdings Berhad (1 is potentially serious!) that you need to take into consideration.

If you're unsure about the strength of Xin Hwa Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:XINHWA

Xin Hwa Holdings Berhad

An investment holding company, engage in the provision of integrated logistics services in Malaysia, Singapore, and Indonesia.

Good value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success