- Malaysia

- /

- Marine and Shipping

- /

- KLSE:MAYBULK

Malaysian Bulk Carriers Berhad's (KLSE:MAYBULK) Shareholders Are Down 30% On Their Shares

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Malaysian Bulk Carriers Berhad (KLSE:MAYBULK) shareholders have had that experience, with the share price dropping 30% in three years, versus a market decline of about 1.4%. The falls have accelerated recently, with the share price down 19% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Malaysian Bulk Carriers Berhad

Malaysian Bulk Carriers Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Malaysian Bulk Carriers Berhad saw its revenue shrink by 9.0% per year. That is not a good result. The annual decline of 9% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

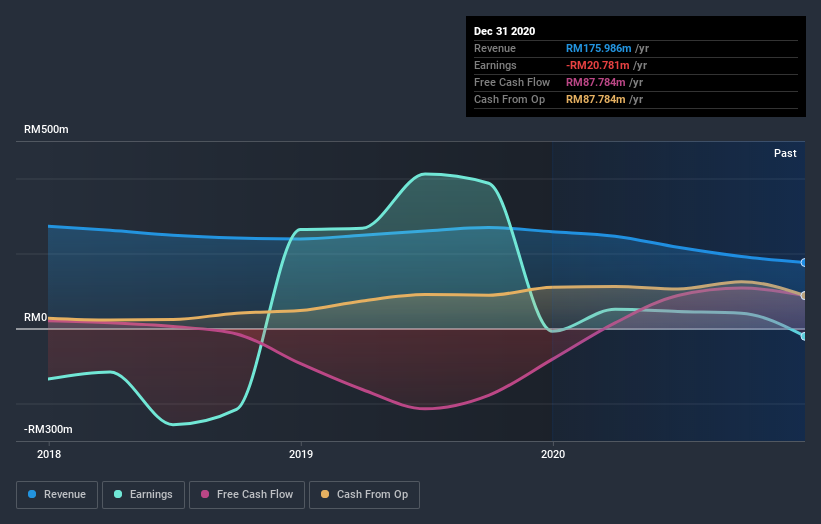

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Malaysian Bulk Carriers Berhad's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Malaysian Bulk Carriers Berhad shareholders have received a total shareholder return of 29% over the last year. There's no doubt those recent returns are much better than the TSR loss of 0.9% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Malaysian Bulk Carriers Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MAYBULK

Maybulk Berhad

An investment holding company, provides dry bulk shipping services in Malaysia and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.