- Malaysia

- /

- Marine and Shipping

- /

- KLSE:HUBLINE

Investors Give Hubline Berhad (KLSE:HUBLINE) Shares A 40% Hiding

The Hubline Berhad (KLSE:HUBLINE) share price has softened a substantial 40% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 67%, which is great even in a bull market.

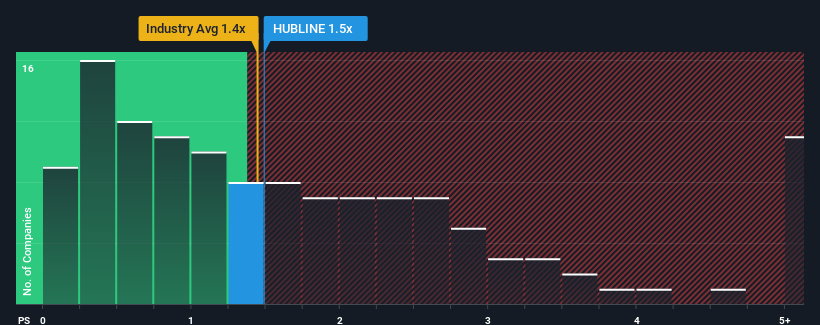

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Hubline Berhad's P/S ratio of 1.5x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in Malaysia is also close to 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Hubline Berhad

How Hubline Berhad Has Been Performing

For example, consider that Hubline Berhad's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hubline Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hubline Berhad's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.3%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 9.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Hubline Berhad's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Hubline Berhad's P/S?

Following Hubline Berhad's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hubline Berhad currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 4 warning signs for Hubline Berhad (1 is a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of Hubline Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hubline Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HUBLINE

Hubline Berhad

An investment holding company, provides dry bulk shipping services in the South East Asian region.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives