Does AirAsia X Berhad (KLSE:AAX) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, AirAsia X Berhad (KLSE:AAX) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for AirAsia X Berhad

How Much Debt Does AirAsia X Berhad Carry?

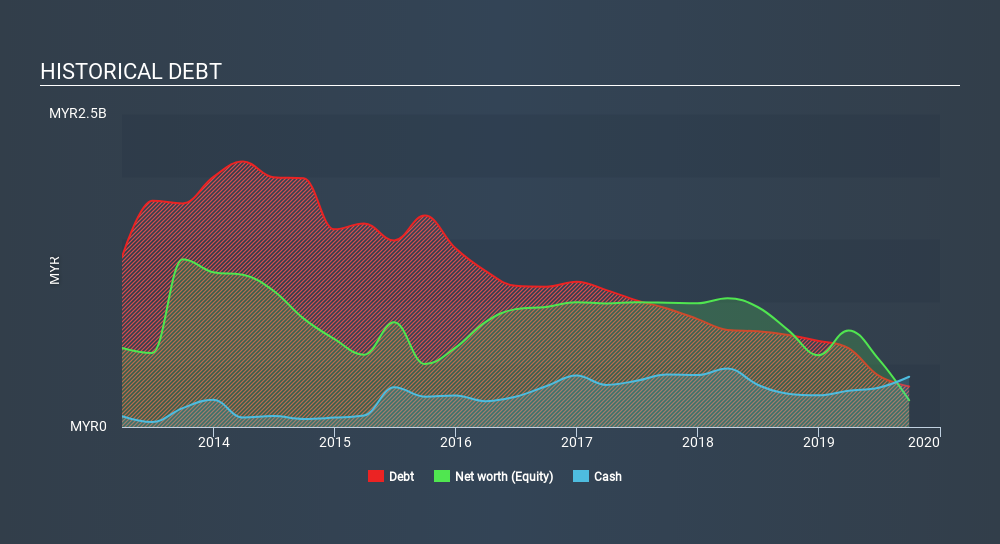

You can click the graphic below for the historical numbers, but it shows that as of September 2019 AirAsia X Berhad had RM324.4m of debt, an increase on RM735, over one year. But on the other hand it also has RM401.4m in cash, leading to a RM77.0m net cash position.

How Strong Is AirAsia X Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that AirAsia X Berhad had liabilities of RM2.31b due within 12 months and liabilities of RM7.07b due beyond that. On the other hand, it had cash of RM401.4m and RM271.6m worth of receivables due within a year. So it has liabilities totalling RM8.71b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM643.0m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, AirAsia X Berhad would likely require a major re-capitalisation if it had to pay its creditors today. Given that AirAsia X Berhad has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine AirAsia X Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, AirAsia X Berhad made a loss at the EBIT level, and saw its revenue drop to RM4.4b, which is a fall of 6.5%. We would much prefer see growth.

So How Risky Is AirAsia X Berhad?

While AirAsia X Berhad lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow RM442m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how AirAsia X Berhad's profit, revenue, and operating cashflow have changed over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:AAX

AirAsia X Berhad

Provides long haul air transportation services under the AirAsia brand in Malaysia, Thailand, and Indonesia.

Outstanding track record and undervalued.

Market Insights

Community Narratives