Stock Analysis

Telekom Malaysia Berhad (KLSE:TM) Is Reducing Its Dividend To RM0.06

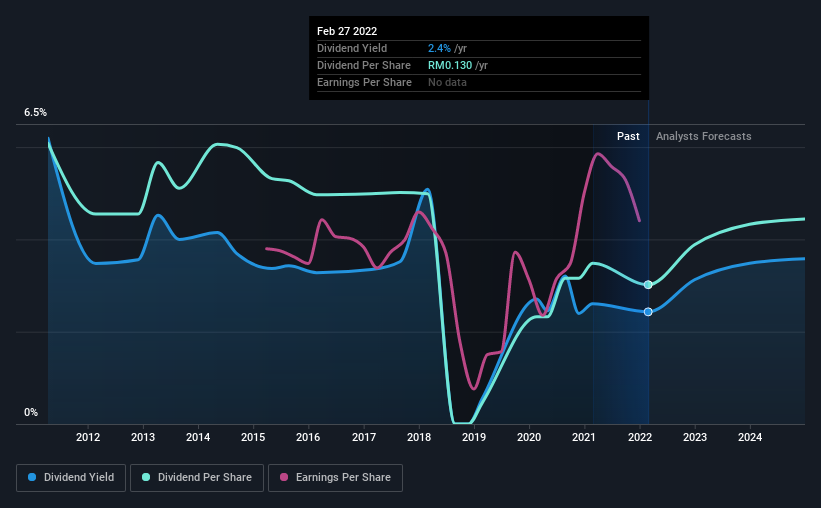

Telekom Malaysia Berhad's (KLSE:TM) dividend is being reduced to RM0.06 on the 31st of March. This means that the annual payment is 2.4% of the current stock price, which is lower than what the rest of the industry is paying.

Check out our latest analysis for Telekom Malaysia Berhad

Telekom Malaysia Berhad's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, Telekom Malaysia Berhad's dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 31.6%. Assuming the dividend continues along recent trends, we think the payout ratio could be 37% by next year, which is in a pretty sustainable range.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2012, the first annual payment was RM0.26, compared to the most recent full-year payment of RM0.13. Doing the maths, this is a decline of about 6.8% per year. A company that decreases its dividend over time generally isn't what we are looking for.

Telekom Malaysia Berhad May Find It Hard To Grow The Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Earnings per share has been crawling upwards at 2.5% per year. The company has been growing at a pretty soft 2.5% per annum, and is paying out quite a lot of its earnings to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

In Summary

Even though the dividend was cut this year, we think Telekom Malaysia Berhad has the ability to make consistent payments in the future. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Telekom Malaysia Berhad that investors should take into consideration. Is Telekom Malaysia Berhad not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Telekom Malaysia Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TM

Telekom Malaysia Berhad

Engages in the establishment, maintenance, and provision of telecommunications and related services in Malaysia and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.