Do V.S. Industry Berhad's (KLSE:VS) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in V.S. Industry Berhad (KLSE:VS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for V.S. Industry Berhad

How Fast Is V.S. Industry Berhad Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, V.S. Industry Berhad has grown EPS by 7.9% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

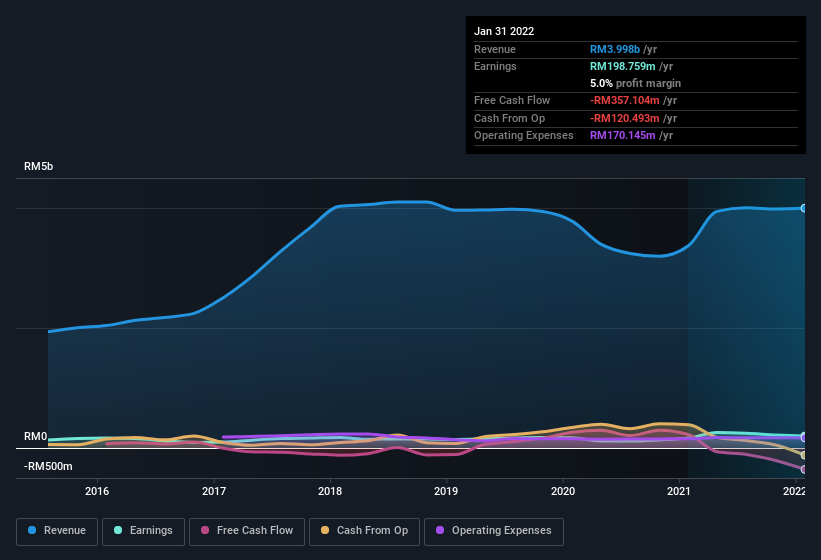

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. V.S. Industry Berhad maintained stable EBIT margins over the last year, all while growing revenue 18% to RM4.0b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of V.S. Industry Berhad's forecast profits?

Are V.S. Industry Berhad Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own V.S. Industry Berhad shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at RM1.0b. Coming in at 28% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Is V.S. Industry Berhad Worth Keeping An Eye On?

One important encouraging feature of V.S. Industry Berhad is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Before you take the next step you should know about the 2 warning signs for V.S. Industry Berhad (1 is concerning!) that we have uncovered.

Although V.S. Industry Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VS

V.S. Industry Berhad

An investment holding company, engages in the manufacturing, assembling and selling electronic and electrical products, and plastic molded components and parts.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives