- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:NOTION

Shareholders Of Notion VTec Berhad (KLSE:NOTION) Must Be Happy With Their 248% Total Return

It hasn't been the best quarter for Notion VTec Berhad (KLSE:NOTION) shareholders, since the share price has fallen 23% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 220% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

Check out our latest analysis for Notion VTec Berhad

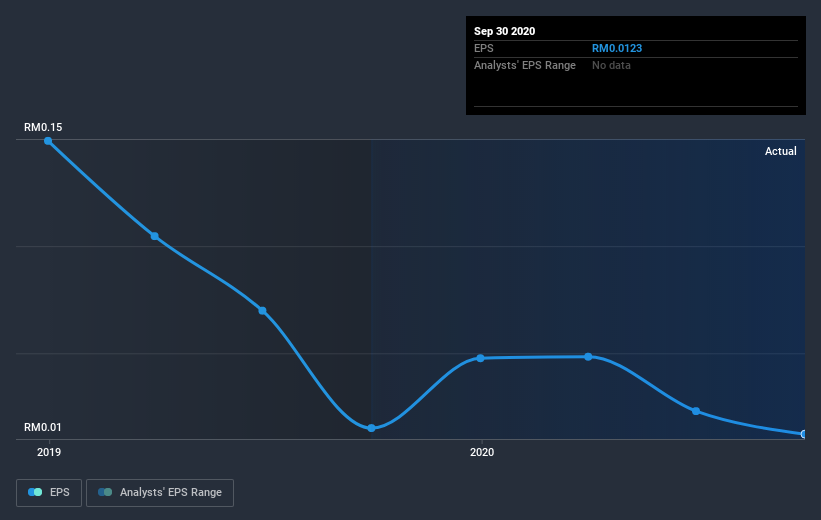

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Notion VTec Berhad became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Notion VTec Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Notion VTec Berhad's TSR of 248% over the last 5 years is better than the share price return.

A Different Perspective

We're pleased to report that Notion VTec Berhad shareholders have received a total shareholder return of 32% over one year. That gain is better than the annual TSR over five years, which is 28%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Notion VTec Berhad .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you’re looking to trade Notion VTec Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Notion VTec Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:NOTION

Notion VTec Berhad

An investment holding company, engages in design, manufacture, and sale of precision components and tools.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.