- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:NOTION

Notion VTec Berhad (KLSE:NOTION) Stock Rockets 195% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Notion VTec Berhad (KLSE:NOTION) shares have been powering on, with a gain of 195% in the last thirty days. The last 30 days were the cherry on top of the stock's 416% gain in the last year, which is nothing short of spectacular.

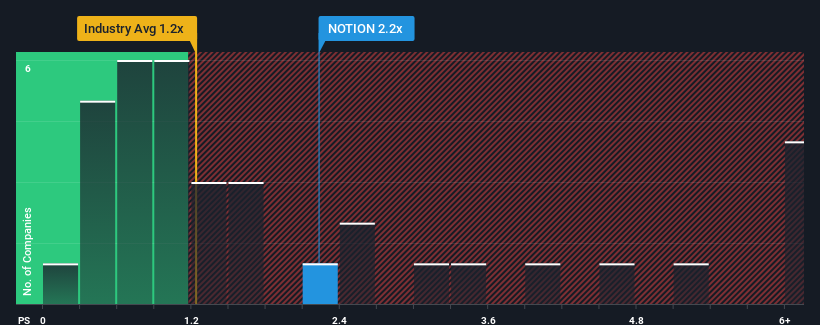

After such a large jump in price, given close to half the companies operating in Malaysia's Electronic industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Notion VTec Berhad as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Notion VTec Berhad

How Notion VTec Berhad Has Been Performing

Revenue has risen firmly for Notion VTec Berhad recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Notion VTec Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Notion VTec Berhad's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Notion VTec Berhad's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in Notion VTec Berhad's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Notion VTec Berhad currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Notion VTec Berhad that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Notion VTec Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NOTION

Notion VTec Berhad

An investment holding company, engages in design, manufacture, and sale of precision components and tools.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion