K-One Technology Berhad's (KLSE:K1) 27% Price Boost Is Out Of Tune With Revenues

K-One Technology Berhad (KLSE:K1) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 35%.

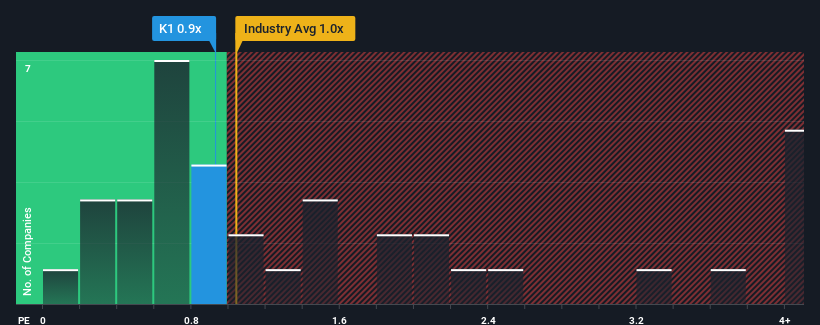

Although its price has surged higher, you could still be forgiven for feeling indifferent about K-One Technology Berhad's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Malaysia is also close to 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for K-One Technology Berhad

How K-One Technology Berhad Has Been Performing

Revenue has risen firmly for K-One Technology Berhad recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on K-One Technology Berhad will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For K-One Technology Berhad?

There's an inherent assumption that a company should be matching the industry for P/S ratios like K-One Technology Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.6%. The latest three year period has also seen an excellent 55% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 43% shows it's noticeably less attractive.

In light of this, it's curious that K-One Technology Berhad's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On K-One Technology Berhad's P/S

K-One Technology Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that K-One Technology Berhad's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 2 warning signs for K-One Technology Berhad you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if K-One Technology Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:K1

K-One Technology Berhad

Engages in the research, design, and development of electronic end-products and sub-systems for the healthcare, medical, Internet of Things (IoT), industrial, and consumer electronics industries.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026