Should You Be Impressed By JHM Consolidation Berhad's (KLSE:JHM) Returns on Capital?

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of JHM Consolidation Berhad (KLSE:JHM) looks decent, right now, so lets see what the trend of returns can tell us.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for JHM Consolidation Berhad, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = RM32m ÷ (RM322m - RM74m) (Based on the trailing twelve months to September 2020).

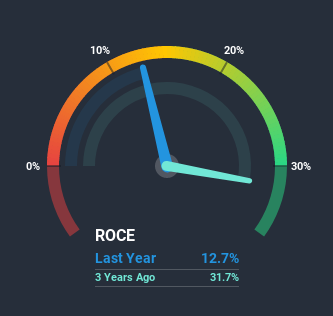

Therefore, JHM Consolidation Berhad has an ROCE of 13%. That's a relatively normal return on capital, and it's around the 12% generated by the Electronic industry.

View our latest analysis for JHM Consolidation Berhad

In the above chart we have measured JHM Consolidation Berhad's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for JHM Consolidation Berhad.

What Can We Tell From JHM Consolidation Berhad's ROCE Trend?

While the current returns on capital are decent, they haven't changed much. Over the past five years, ROCE has remained relatively flat at around 13% and the business has deployed 522% more capital into its operations. 13% is a pretty standard return, and it provides some comfort knowing that JHM Consolidation Berhad has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 23% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.The Key Takeaway

The main thing to remember is that JHM Consolidation Berhad has proven its ability to continually reinvest at respectable rates of return. And the stock has done incredibly well with a 1,555% return over the last five years, so long term investors are no doubt ecstatic with that result. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

JHM Consolidation Berhad does have some risks though, and we've spotted 1 warning sign for JHM Consolidation Berhad that you might be interested in.

While JHM Consolidation Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading JHM Consolidation Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:JHM

JHM Consolidation Berhad

An investment holding company, designs, assembles, and manufactures metal parts and components, and electronic components in Malaysia, the United States, Europe, Malaysia, Oceania, and the Asia Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026