Are Strong Financial Prospects The Force That Is Driving The Momentum In JHM Consolidation Berhad's KLSE:JHM) Stock?

JHM Consolidation Berhad (KLSE:JHM) has had a great run on the share market with its stock up by a significant 31% over the last month. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to JHM Consolidation Berhad's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for JHM Consolidation Berhad

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for JHM Consolidation Berhad is:

9.9% = RM21m ÷ RM213m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every MYR1 of its shareholder's investments, the company generates a profit of MYR0.10.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

JHM Consolidation Berhad's Earnings Growth And 9.9% ROE

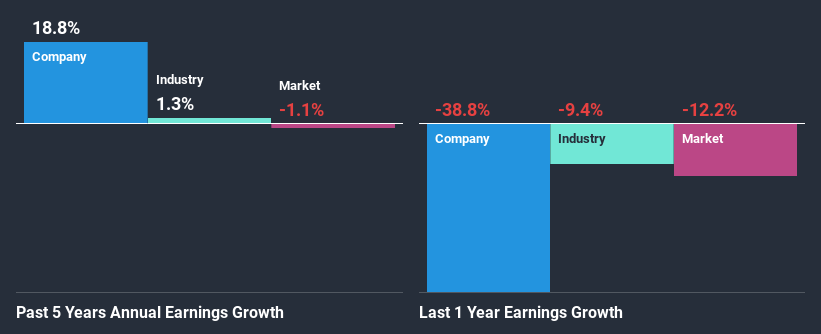

On the face of it, JHM Consolidation Berhad's ROE is not much to talk about. However, the fact that the company's ROE is higher than the average industry ROE of 6.9%, is definitely interesting. This probably goes some way in explaining JHM Consolidation Berhad's moderate 19% growth over the past five years amongst other factors. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Hence there might be some other aspects that are causing earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

We then compared JHM Consolidation Berhad's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 1.3% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about JHM Consolidation Berhad's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is JHM Consolidation Berhad Making Efficient Use Of Its Profits?

JHM Consolidation Berhad has a three-year median payout ratio of 26%, which implies that it retains the remaining 74% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Moreover, JHM Consolidation Berhad is determined to keep sharing its profits with shareholders which we infer from its long history of three years of paying a dividend. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 35% over the next three years. Regardless, the future ROE for JHM Consolidation Berhad is speculated to rise to 22% despite the anticipated increase in the payout ratio. There could probably be other factors that could be driving the future growth in the ROE.

Summary

Overall, we are quite pleased with JHM Consolidation Berhad's performance. In particular, it's great to see that the company has seen significant growth in its earnings backed by a respectable ROE and a high reinvestment rate. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade JHM Consolidation Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:JHM

JHM Consolidation Berhad

An investment holding company, designs, assembles, and manufactures metal parts and components, and electronic components in Malaysia, the United States, Europe, Malaysia, Oceania, and the Asia Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.