- Malaysia

- /

- Tech Hardware

- /

- KLSE:IRIS

Shareholders Will Probably Hold Off On Increasing IRIS Corporation Berhad's (KLSE:IRIS) CEO Compensation For The Time Being

In the past three years, shareholders of IRIS Corporation Berhad (KLSE:IRIS) have seen a loss on their investment. Per share earnings growth is also poor, despite revenues growing. The AGM coming up on 27 September 2022 will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

See our latest analysis for IRIS Corporation Berhad

How Does Total Compensation For Shaiful Bin Subhan Compare With Other Companies In The Industry?

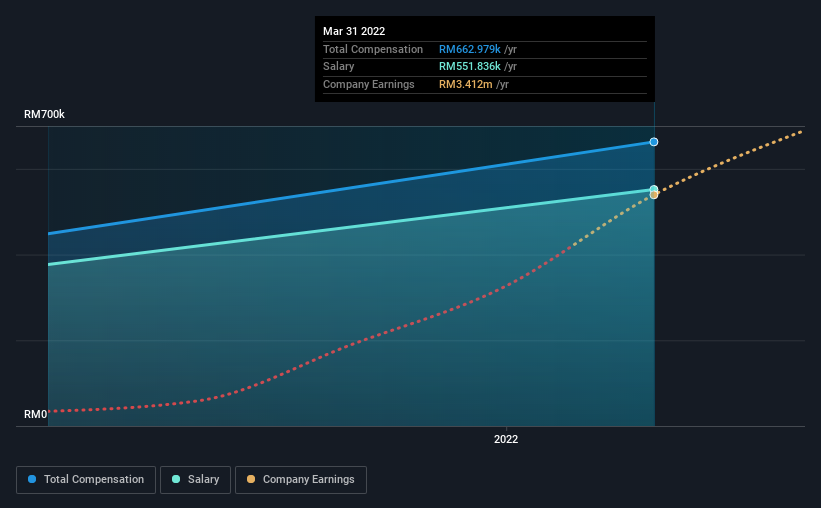

At the time of writing, our data shows that IRIS Corporation Berhad has a market capitalization of RM408m, and reported total annual CEO compensation of RM663k for the year to March 2022. We note that's an increase of 48% above last year. In particular, the salary of RM551.8k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below RM910m, reported a median total CEO compensation of RM560k. From this we gather that Shaiful Bin Subhan is paid around the median for CEOs in the industry. What's more, Shaiful Bin Subhan holds RM1.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | RM552k | RM377k | 83% |

| Other | RM111k | RM72k | 17% |

| Total Compensation | RM663k | RM449k | 100% |

On an industry level, roughly 88% of total compensation represents salary and 12% is other remuneration. Although there is a difference in how total compensation is set, IRIS Corporation Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at IRIS Corporation Berhad's Growth Numbers

Over the last three years, IRIS Corporation Berhad has shrunk its earnings per share by 42% per year. In the last year, its revenue is up 130%.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has IRIS Corporation Berhad Been A Good Investment?

Given the total shareholder loss of 14% over three years, many shareholders in IRIS Corporation Berhad are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for IRIS Corporation Berhad that investors should look into moving forward.

Important note: IRIS Corporation Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IRIS

IRIS Corporation Berhad

Provides technology consulting solutions in Malaysia, Asia, Oceania, Africa, and North America.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion