- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:CNERGEN

Some Cnergenz Berhad (KLSE:CNERGEN) Shareholders Look For Exit As Shares Take 33% Pounding

Unfortunately for some shareholders, the Cnergenz Berhad (KLSE:CNERGEN) share price has dived 33% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

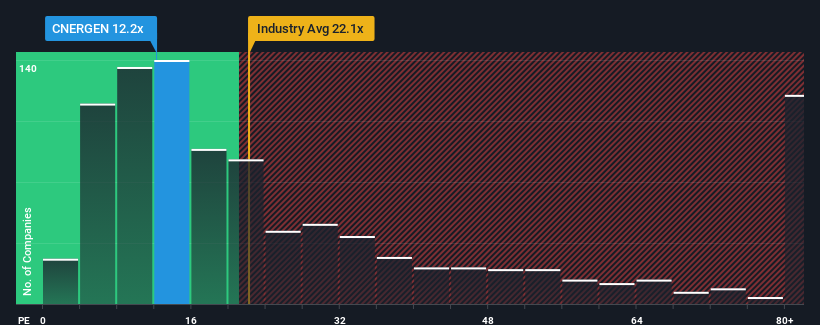

Even after such a large drop in price, it's still not a stretch to say that Cnergenz Berhad's price-to-earnings (or "P/E") ratio of 12.2x right now seems quite "middle-of-the-road" compared to the market in Malaysia, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Cnergenz Berhad's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Cnergenz Berhad

Does Growth Match The P/E?

In order to justify its P/E ratio, Cnergenz Berhad would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This means it has also seen a slide in earnings over the longer-term as EPS is down 19% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's an unpleasant look.

With this information, we find it concerning that Cnergenz Berhad is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Cnergenz Berhad's plummeting stock price has brought its P/E right back to the rest of the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cnergenz Berhad revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 4 warning signs for Cnergenz Berhad (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on Cnergenz Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CNERGEN

Cnergenz Berhad

An investment holding company, provides electronics manufacturing solutions in Malaysia, Thailand, Vietnam, rest of Asia, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)