N2N Connect Berhad (KLSE:N2N) Is Reducing Its Dividend To RM0.01

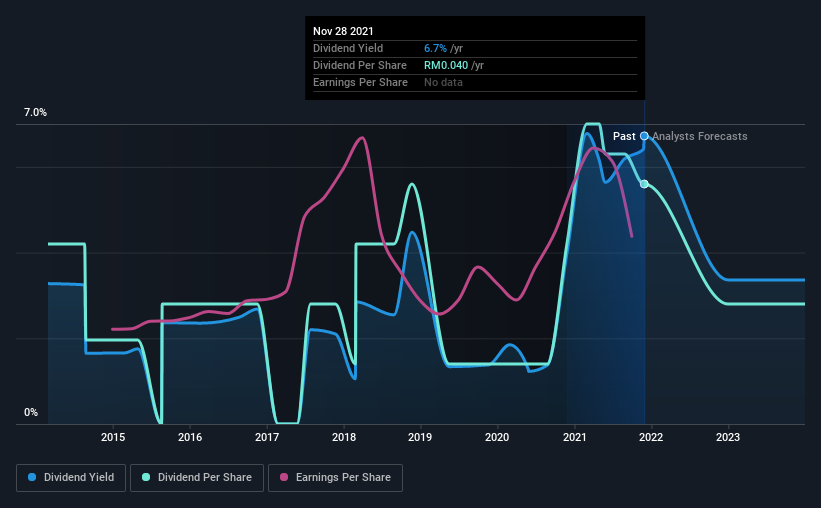

N2N Connect Berhad (KLSE:N2N) has announced it will be reducing its dividend payable on the 28th of December to RM0.01. However, the dividend yield of 6.7% is still a decent boost to shareholder returns.

Check out our latest analysis for N2N Connect Berhad

N2N Connect Berhad Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. N2N Connect Berhad was earning enough to cover the previous dividend, but it was paying out quite a large proportion of its free cash flows. The business is earning enough to make the dividend feasible, but the cash payout ratio of 77% indicates it is more focused on returning cash to shareholders than growing the business.

Looking forward, earnings per share is forecast to fall by 18.1% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 139%, which could put the dividend under pressure if earnings don't start to improve.

N2N Connect Berhad's Dividend Has Lacked Consistency

Looking back, N2N Connect Berhad's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. The first annual payment during the last 8 years was RM0.03 in 2013, and the most recent fiscal year payment was RM0.04. This means that it has been growing its distributions at 3.7% per annum over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

We Could See N2N Connect Berhad's Dividend Growing

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see N2N Connect Berhad has been growing its earnings per share at 8.8% a year over the past five years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While N2N Connect Berhad is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 4 warning signs for N2N Connect Berhad you should be aware of, and 1 of them is significant. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

Valuation is complex, but we're here to simplify it.

Discover if N2N Connect Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:N2N

N2N Connect Berhad

An investment holding company, engages in the research and development of software packages in Malaysia, Hong Kong, China, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026