Microlink Solutions Berhad (KLSE:MICROLN) Is Making Moderate Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Microlink Solutions Berhad (KLSE:MICROLN) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Microlink Solutions Berhad

What Is Microlink Solutions Berhad's Debt?

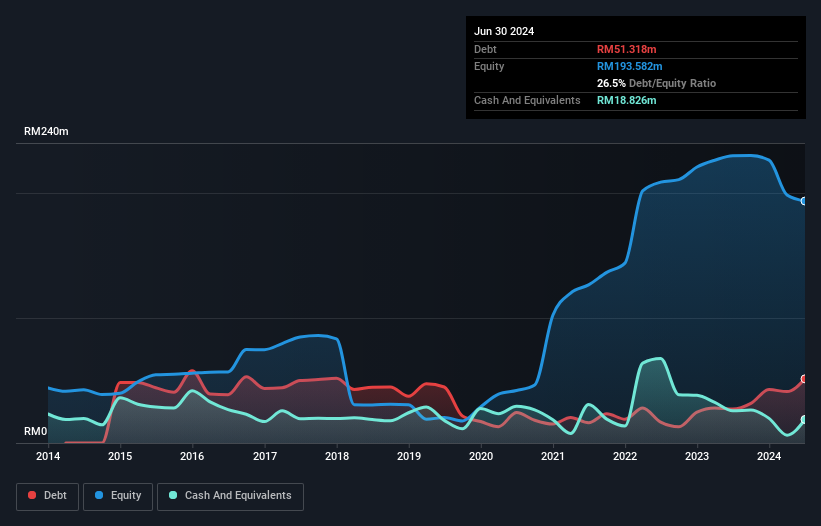

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Microlink Solutions Berhad had RM51.3m of debt, an increase on RM27.1m, over one year. However, because it has a cash reserve of RM18.8m, its net debt is less, at about RM32.5m.

How Healthy Is Microlink Solutions Berhad's Balance Sheet?

The latest balance sheet data shows that Microlink Solutions Berhad had liabilities of RM121.7m due within a year, and liabilities of RM8.39m falling due after that. Offsetting these obligations, it had cash of RM18.8m as well as receivables valued at RM130.2m due within 12 months. So it can boast RM18.9m more liquid assets than total liabilities.

This surplus suggests that Microlink Solutions Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Microlink Solutions Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Microlink Solutions Berhad reported revenue of RM286m, which is a gain of 14%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Microlink Solutions Berhad produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping RM31m. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. This one is a bit too risky for our liking. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Microlink Solutions Berhad has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MICROLN

Microlink Solutions Berhad

An investment holding company, researches and develops information technology solutions to the financial services industry in Malaysia and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks