David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Microlink Solutions Berhad (KLSE:MICROLN) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Microlink Solutions Berhad

What Is Microlink Solutions Berhad's Debt?

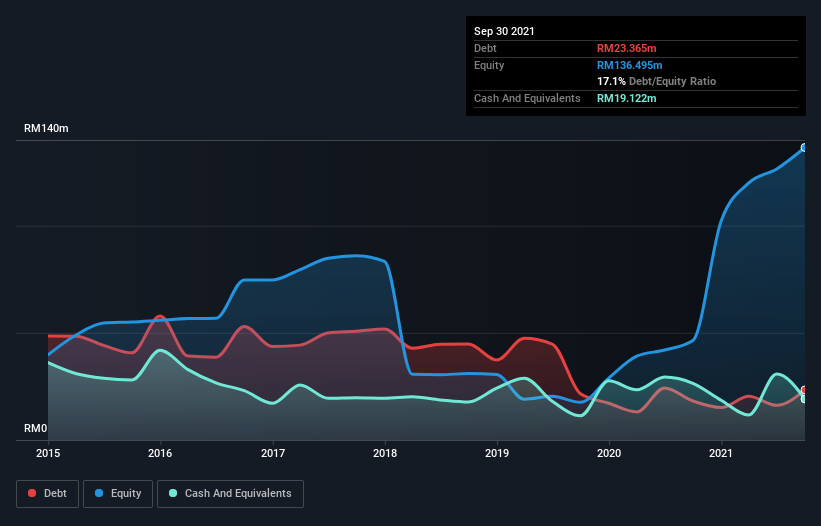

The image below, which you can click on for greater detail, shows that at September 2021 Microlink Solutions Berhad had debt of RM23.4m, up from RM18.2m in one year. However, it also had RM19.1m in cash, and so its net debt is RM4.24m.

A Look At Microlink Solutions Berhad's Liabilities

According to the last reported balance sheet, Microlink Solutions Berhad had liabilities of RM85.8m due within 12 months, and liabilities of RM7.64m due beyond 12 months. Offsetting this, it had RM19.1m in cash and RM95.8m in receivables that were due within 12 months. So it can boast RM21.4m more liquid assets than total liabilities.

This surplus suggests that Microlink Solutions Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty. But either way, Microlink Solutions Berhad has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Microlink Solutions Berhad's net debt is only 0.10 times its EBITDA. And its EBIT easily covers its interest expense, being 22.4 times the size. So we're pretty relaxed about its super-conservative use of debt. Even more impressive was the fact that Microlink Solutions Berhad grew its EBIT by 133% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But it is Microlink Solutions Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, Microlink Solutions Berhad actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Happily, Microlink Solutions Berhad's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. When we consider the range of factors above, it looks like Microlink Solutions Berhad is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Microlink Solutions Berhad (1 is a bit concerning!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MICROLN

Microlink Solutions Berhad

An investment holding company, researches and develops information technology solutions to the financial services industry in Malaysia and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.