Has LGMS Berhad's (KLSE:LGMS) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

LGMS Berhad (KLSE:LGMS) has had a great run on the share market with its stock up by a significant 33% over the last three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on LGMS Berhad's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for LGMS Berhad

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for LGMS Berhad is:

13% = RM11m ÷ RM87m (Based on the trailing twelve months to December 2023).

The 'return' is the yearly profit. So, this means that for every MYR1 of its shareholder's investments, the company generates a profit of MYR0.13.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of LGMS Berhad's Earnings Growth And 13% ROE

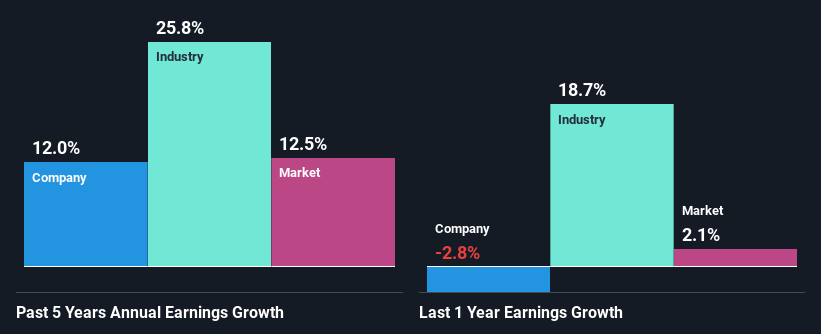

To start with, LGMS Berhad's ROE looks acceptable. Further, the company's ROE is similar to the industry average of 12%. This probably goes some way in explaining LGMS Berhad's moderate 12% growth over the past five years amongst other factors.

As a next step, we compared LGMS Berhad's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 26% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about LGMS Berhad's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is LGMS Berhad Making Efficient Use Of Its Profits?

LGMS Berhad has a significant three-year median payout ratio of 76%, meaning that it is left with only 24% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

While LGMS Berhad has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 20% over the next three years. As a result, the expected drop in LGMS Berhad's payout ratio explains the anticipated rise in the company's future ROE to 21%, over the same period.

Summary

In total, it does look like LGMS Berhad has some positive aspects to its business. The company has grown its earnings moderately as previously discussed. Still, the high ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be quite low. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of LGMS Berhad's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LGMS

LGMS Berhad

Provides cybersecurity services in Malaysia and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.