The Price Is Right For Infoline Tec Group Berhad (KLSE:INFOTEC) Even After Diving 27%

The Infoline Tec Group Berhad (KLSE:INFOTEC) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 15% in the last year.

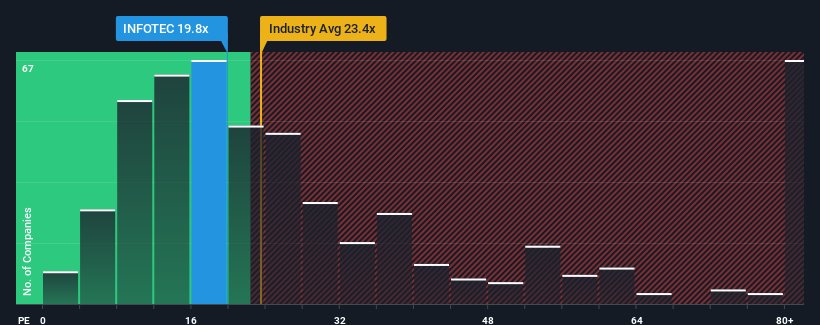

Although its price has dipped substantially, Infoline Tec Group Berhad may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.8x, since almost half of all companies in Malaysia have P/E ratios under 17x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Infoline Tec Group Berhad certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Infoline Tec Group Berhad

Is There Enough Growth For Infoline Tec Group Berhad?

There's an inherent assumption that a company should outperform the market for P/E ratios like Infoline Tec Group Berhad's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 99% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 59% during the coming year according to the dual analysts following the company. With the market only predicted to deliver 18%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Infoline Tec Group Berhad's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Infoline Tec Group Berhad's P/E

Despite the recent share price weakness, Infoline Tec Group Berhad's P/E remains higher than most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Infoline Tec Group Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Infoline Tec Group Berhad you should be aware of, and 1 of them doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:INFOTEC

Infoline Tec Group Berhad

An investment holding company, provides information technology (IT) infrastructure and cybersecurity solutions, and managed IT and other IT services.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026