A Rising Share Price Has Us Looking Closely At Datasonic Group Berhad's (KLSE:DSONIC) P/E Ratio

Datasonic Group Berhad (KLSE:DSONIC) shares have had a really impressive month, gaining 56%, after some slippage. That's tops off a massive gain of 252% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

Check out our latest analysis for Datasonic Group Berhad

How Does Datasonic Group Berhad's P/E Ratio Compare To Its Peers?

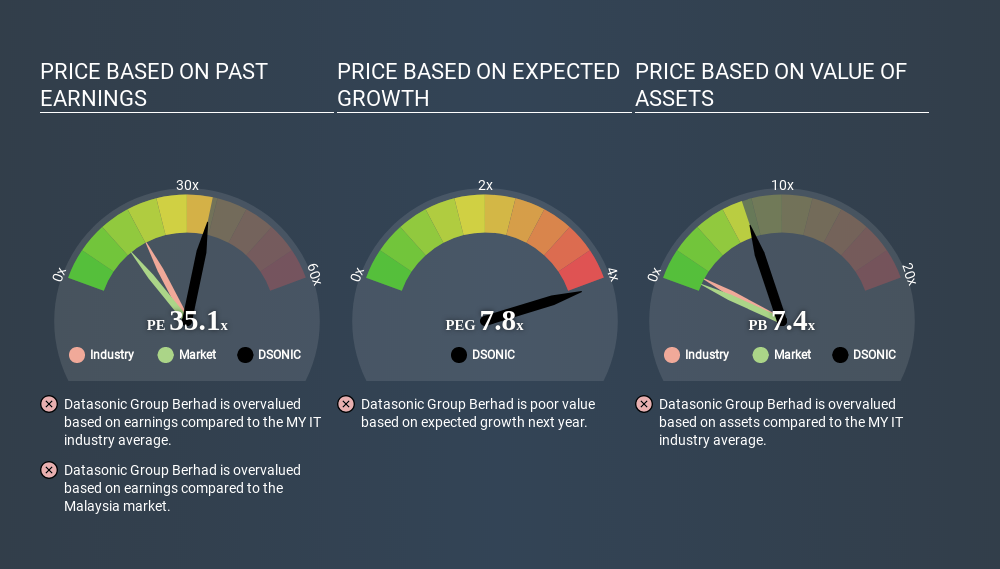

We can tell from its P/E ratio of 35.06 that there is some investor optimism about Datasonic Group Berhad. The image below shows that Datasonic Group Berhad has a higher P/E than the average (18.2) P/E for companies in the it industry.

Datasonic Group Berhad's P/E tells us that market participants think the company will perform better than its industry peers, going forward. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

When earnings fall, the 'E' decreases, over time. That means even if the current P/E is low, it will increase over time if the share price stays flat. Then, a higher P/E might scare off shareholders, pushing the share price down.

Datasonic Group Berhad increased earnings per share by a whopping 41% last year. But earnings per share are down 1.7% per year over the last five years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

So What Does Datasonic Group Berhad's Balance Sheet Tell Us?

Since Datasonic Group Berhad holds net cash of RM16m, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Verdict On Datasonic Group Berhad's P/E Ratio

Datasonic Group Berhad's P/E is 35.1 which is above average (13.3) in its market. The excess cash it carries is the gravy on top its fast EPS growth. So based on this analysis we'd expect Datasonic Group Berhad to have a high P/E ratio. What is very clear is that the market has become significantly more optimistic about Datasonic Group Berhad over the last month, with the P/E ratio rising from 22.5 back then to 35.1 today. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Datasonic Group Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:NEXG

NEXG Berhad

An investment holding company, provides security-based information and communication technology (ICT) solutions primarily in Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026