- Malaysia

- /

- Semiconductors

- /

- KLSE:MPI

Malaysian Pacific Industries Berhad's (KLSE:MPI) Stock Retreats 28% But Earnings Haven't Escaped The Attention Of Investors

The Malaysian Pacific Industries Berhad (KLSE:MPI) share price has fared very poorly over the last month, falling by a substantial 28%. Longer-term shareholders would now have taken a real hit with the stock declining 2.8% in the last year.

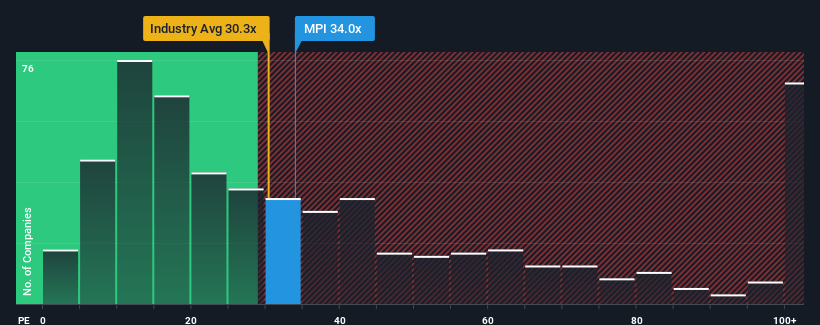

Even after such a large drop in price, Malaysian Pacific Industries Berhad's price-to-earnings (or "P/E") ratio of 34x might still make it look like a strong sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 16x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Malaysian Pacific Industries Berhad as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Malaysian Pacific Industries Berhad

Does Growth Match The High P/E?

Malaysian Pacific Industries Berhad's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 168%. However, this wasn't enough as the latest three year period has seen a very unpleasant 40% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 22% each year over the next three years. With the market only predicted to deliver 13% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Malaysian Pacific Industries Berhad's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Malaysian Pacific Industries Berhad's shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Malaysian Pacific Industries Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Malaysian Pacific Industries Berhad with six simple checks.

If you're unsure about the strength of Malaysian Pacific Industries Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MPI

Malaysian Pacific Industries Berhad

An investment holding company, engages in the manufacturing, assembling, testing, marketing, and sale of integrated circuits, semiconductor devices, electronic components, and lead frames.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.