Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, KESM Industries Berhad (KLSE:KESM) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does KESM Industries Berhad Carry?

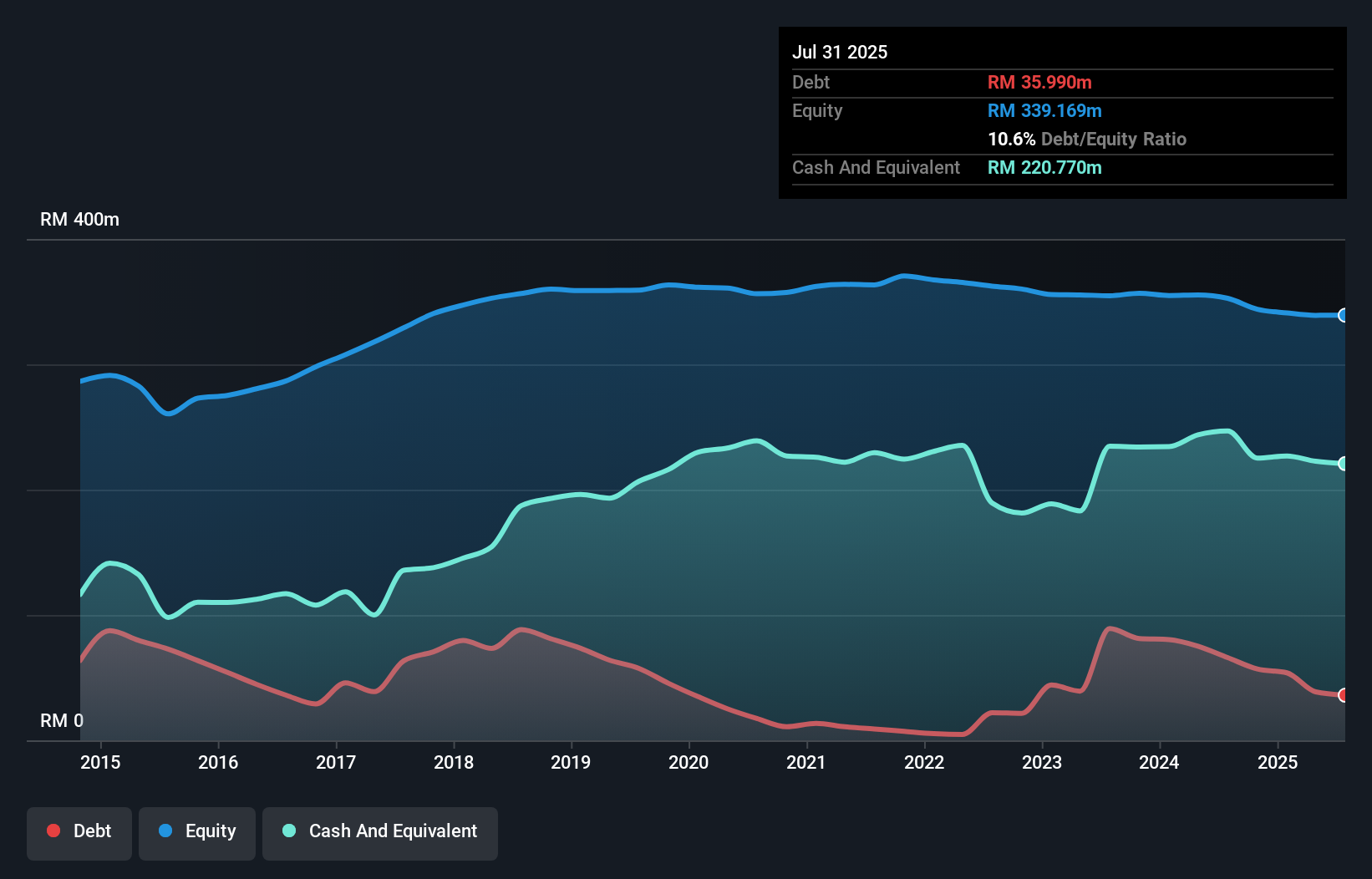

The image below, which you can click on for greater detail, shows that KESM Industries Berhad had debt of RM36.0m at the end of July 2025, a reduction from RM66.0m over a year. However, its balance sheet shows it holds RM220.8m in cash, so it actually has RM184.8m net cash.

A Look At KESM Industries Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that KESM Industries Berhad had liabilities of RM58.1m due within 12 months and liabilities of RM18.0m due beyond that. Offsetting these obligations, it had cash of RM220.8m as well as receivables valued at RM49.3m due within 12 months. So it actually has RM194.1m more liquid assets than total liabilities.

This luscious liquidity implies that KESM Industries Berhad's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, KESM Industries Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is KESM Industries Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

See our latest analysis for KESM Industries Berhad

In the last year KESM Industries Berhad had a loss before interest and tax, and actually shrunk its revenue by 12%, to RM220m. That's not what we would hope to see.

So How Risky Is KESM Industries Berhad?

While KESM Industries Berhad lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow RM16m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. There's no doubt the next few years will be crucial to how the business matures. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that KESM Industries Berhad is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if KESM Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KESM

KESM Industries Berhad

An investment holding company, provides burn-in and test services to semiconductor manufacturers in Malaysia, the People’s Republic of China, Singapore, the United States, and Europe.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.