Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that KESM Industries Berhad (KLSE:KESM) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for KESM Industries Berhad

What Is KESM Industries Berhad's Debt?

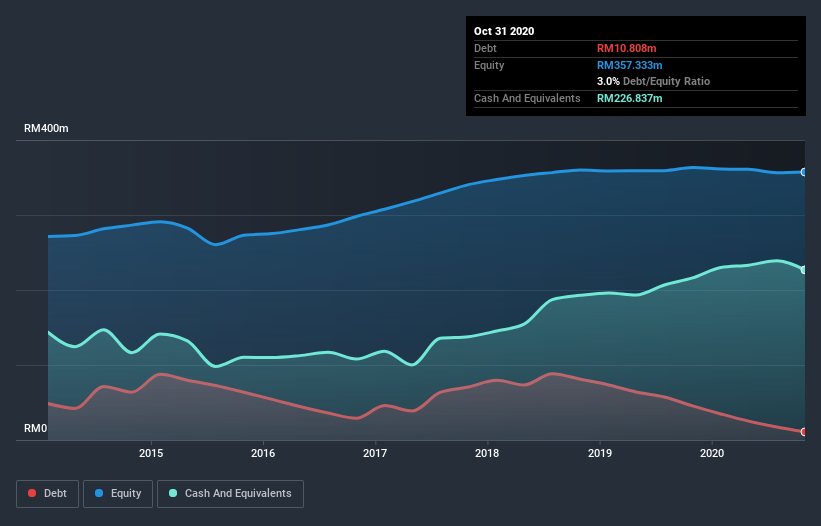

As you can see below, KESM Industries Berhad had RM10.8m of debt at October 2020, down from RM45.4m a year prior. However, it does have RM226.8m in cash offsetting this, leading to net cash of RM216.0m.

How Strong Is KESM Industries Berhad's Balance Sheet?

According to the last reported balance sheet, KESM Industries Berhad had liabilities of RM42.3m due within 12 months, and liabilities of RM8.97m due beyond 12 months. On the other hand, it had cash of RM226.8m and RM51.9m worth of receivables due within a year. So it can boast RM227.5m more liquid assets than total liabilities.

This excess liquidity is a great indication that KESM Industries Berhad's balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, KESM Industries Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine KESM Industries Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year KESM Industries Berhad had a loss before interest and tax, and actually shrunk its revenue by 23%, to RM236m. To be frank that doesn't bode well.

So How Risky Is KESM Industries Berhad?

Although KESM Industries Berhad had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of RM47m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with KESM Industries Berhad , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade KESM Industries Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KESM Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KESM

KESM Industries Berhad

An investment holding company, provides burn-in and test services to semiconductor manufacturers in Malaysia, the People’s Republic of China, Singapore, the United States, and Europe.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.