- Malaysia

- /

- Semiconductors

- /

- KLSE:GTRONIC

Why We're Not Concerned Yet About Globetronics Technology Bhd.'s (KLSE:GTRONIC) 26% Share Price Plunge

To the annoyance of some shareholders, Globetronics Technology Bhd. (KLSE:GTRONIC) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

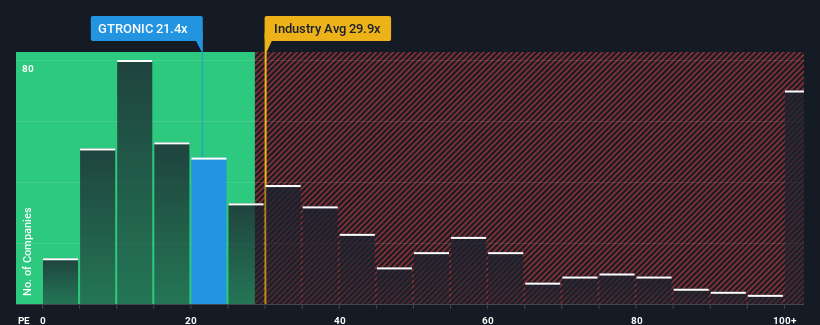

Although its price has dipped substantially, given around half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 15x, you may still consider Globetronics Technology Bhd as a stock to potentially avoid with its 21.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Globetronics Technology Bhd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Globetronics Technology Bhd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Globetronics Technology Bhd would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 52% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14% each year, which is noticeably less attractive.

With this information, we can see why Globetronics Technology Bhd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

There's still some solid strength behind Globetronics Technology Bhd's P/E, if not its share price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Globetronics Technology Bhd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Globetronics Technology Bhd (1 doesn't sit too well with us!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Globetronics Technology Bhd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GTRONIC

Globetronics Technology Bhd

Operates manufacturing facilities in Malaysia.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026