- Malaysia

- /

- Semiconductors

- /

- KLSE:GREATEC

Greatech Technology Berhad's (KLSE:GREATEC) three-year total shareholder returns outpace the underlying earnings growth

It hasn't been the best quarter for Greatech Technology Berhad (KLSE:GREATEC) shareholders, since the share price has fallen 21% in that time. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. Indeed, the share price is up a very strong 168% in that time. After a run like that some may not be surprised to see prices moderate. If the business can perform well for years to come, then the recent drop could be an opportunity.

In light of the stock dropping 8.7% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Greatech Technology Berhad

SWOT Analysis for Greatech Technology Berhad

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Earnings growth over the past year is below its 5-year average.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow faster than the Malaysian market.

- Debt is not well covered by operating cash flow.

- Revenue is forecast to grow slower than 20% per year.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

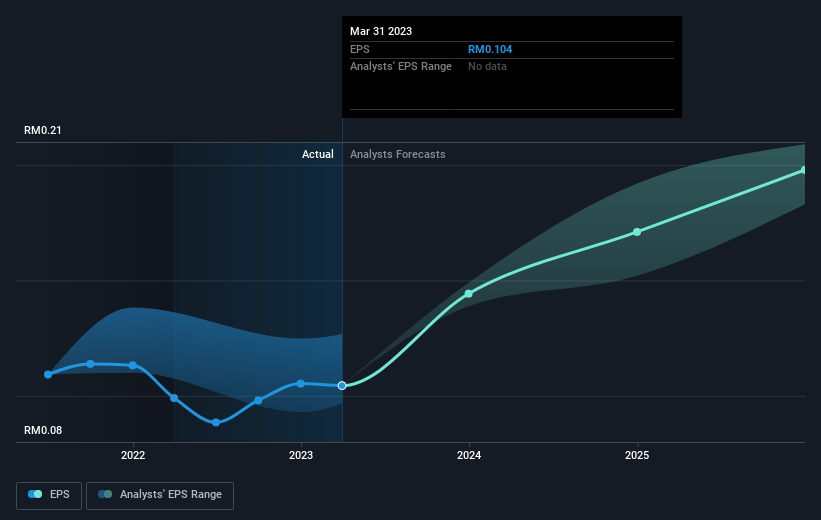

During three years of share price growth, Greatech Technology Berhad achieved compound earnings per share growth of 29% per year. In comparison, the 39% per year gain in the share price outpaces the EPS growth. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Pleasingly, Greatech Technology Berhad's total shareholder return last year was 5.4%. The TSR has been even better over three years, coming in at 39% per year. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Greatech Technology Berhad that you should be aware of before investing here.

Of course Greatech Technology Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

If you're looking to trade Greatech Technology Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GREATEC

Greatech Technology Berhad

An investment holding company, engages in the design and construction of customized factory automation and system integration solutions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives