- Malaysia

- /

- Semiconductors

- /

- KLSE:DNEX

Potential Upside For Dagang NeXchange Berhad (KLSE:DNEX) Not Without Risk

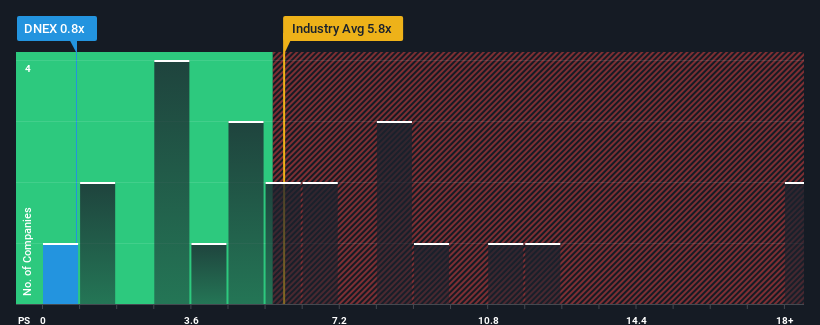

Dagang NeXchange Berhad's (KLSE:DNEX) price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the Semiconductor industry in Malaysia, where around half of the companies have P/S ratios above 5.8x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Dagang NeXchange Berhad

What Does Dagang NeXchange Berhad's Recent Performance Look Like?

Dagang NeXchange Berhad has been struggling lately as its revenue has declined faster than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Dagang NeXchange Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Dagang NeXchange Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Dagang NeXchange Berhad would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 41% over the next year. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we find it odd that Dagang NeXchange Berhad is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Dagang NeXchange Berhad's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Dagang NeXchange Berhad with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Dagang NeXchange Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:DNEX

Dagang NeXchange Berhad

An investment holding company, engages in information technology (IT) and eServices, and energy businesses in Asia, Europe, and North America.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives