- Malaysia

- /

- Industrials

- /

- KLSE:SUNWAY

Shareholders Of Sunway Berhad (KLSE:SUNWAY) Must Be Happy With Their 44% Return

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Sunway Berhad (KLSE:SUNWAY) shareholders have enjoyed a 23% share price rise over the last half decade, well in excess of the market decline of around 4.6% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 4.1% , including dividends .

View our latest analysis for Sunway Berhad

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Sunway Berhad actually saw its EPS drop 17% per year.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. The falling EPS doesn't correlate with the climbing share price, so it's worth taking a look at other metrics.

The modest 1.8% dividend yield is unlikely to be propping up the share price. The revenue reduction of 1.2% per year is not a positive. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

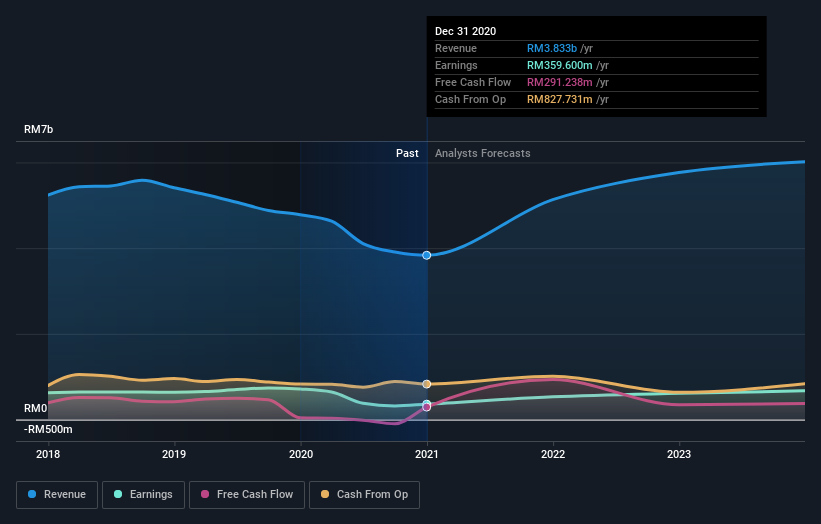

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Sunway Berhad is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Sunway Berhad in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Sunway Berhad the TSR over the last 5 years was 44%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Sunway Berhad shareholders are up 4.1% for the year (even including dividends). Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 8% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Sunway Berhad (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SUNWAY

Sunway Berhad

An investment holding company, operates in the real estate, construction, education, healthcare, retail, and hospitality sectors in Malaysia, Singapore, China, India, Australia, Indonesia, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.