- Malaysia

- /

- Real Estate

- /

- KLSE:MALTON

Malton Berhad's (KLSE:MALTON) Shareholders Are Down 55% On Their Shares

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Malton Berhad (KLSE:MALTON) have had an unfortunate run in the last three years. Unfortunately, they have held through a 55% decline in the share price in that time. Even worse, it's down 13% in about a month, which isn't fun at all.

View our latest analysis for Malton Berhad

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

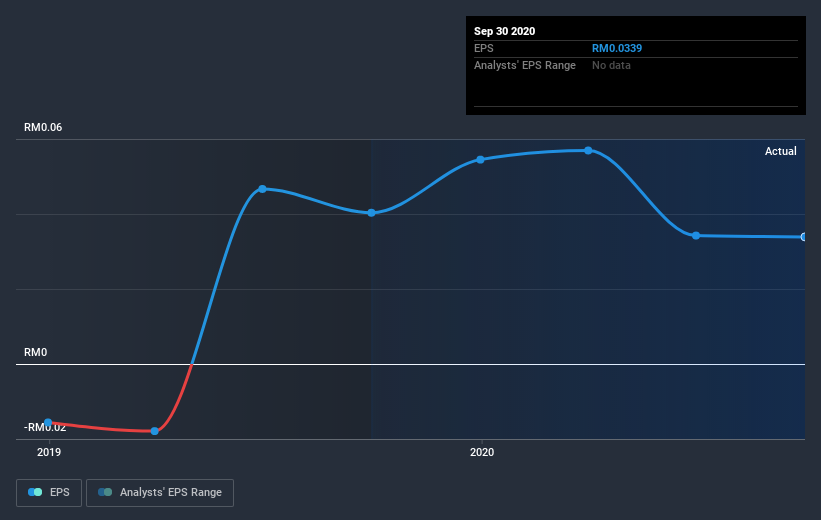

During the three years that the share price fell, Malton Berhad's earnings per share (EPS) dropped by 42% each year. This fall in the EPS is worse than the 24% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Malton Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Malton Berhad's TSR of was a loss of 52% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Malton Berhad had a tough year, with a total loss of 4.3%, against a market gain of about 5.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 5% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Malton Berhad better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Malton Berhad you should be aware of, and 2 of them make us uncomfortable.

Of course Malton Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you’re looking to trade Malton Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MALTON

Malton Berhad

An investment holding company, engages in the investment, development, construction, and sale of properties in Malaysia.

Low and slightly overvalued.

Market Insights

Community Narratives