- Malaysia

- /

- Real Estate

- /

- KLSE:LBS

Analyst Forecasts Just Became More Bearish On LBS Bina Group Berhad (KLSE:LBS)

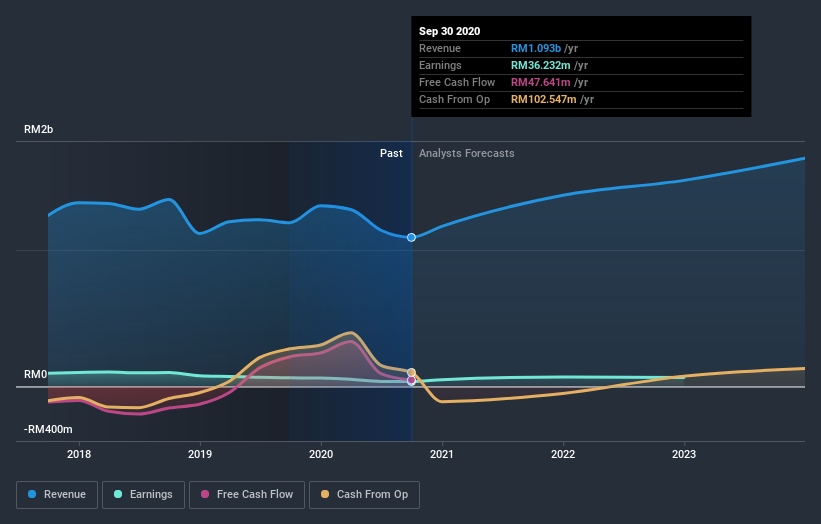

The analysts covering LBS Bina Group Berhad (KLSE:LBS) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

After the downgrade, the five analysts covering LBS Bina Group Berhad are now predicting revenues of RM1.2b in 2021. If met, this would reflect a solid 11% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of RM1.4b in 2021. The consensus view seems to have become more pessimistic on LBS Bina Group Berhad, noting the substantial drop in revenue estimates in this update.

Check out our latest analysis for LBS Bina Group Berhad

We'd point out that there was no major changes to their price target of RM0.47, suggesting the latest estimates were not enough to shift their view on the value of the business. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic LBS Bina Group Berhad analyst has a price target of RM0.55 per share, while the most pessimistic values it at RM0.33. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting LBS Bina Group Berhad's growth to accelerate, with the forecast 11% annualised growth to the end of 2021 ranking favourably alongside historical growth of 8.7% per annum over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 9.8% per year. LBS Bina Group Berhad is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. Analysts also expect revenues to grow approximately in line with the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of LBS Bina Group Berhad going forwards.

That said, the analysts might have good reason to be negative on LBS Bina Group Berhad, given its declining profit margins. Learn more, and discover the 1 other warning sign we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade LBS Bina Group Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LBS

LBS Bina Group Berhad

An investment holding company, primarily engages in property development business in Malaysia and Saudi Arabia.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives