- Malaysia

- /

- Real Estate

- /

- KLSE:E&O

Would Shareholders Who Purchased Eastern & Oriental Berhad's (KLSE:E&O) Stock Three Years Be Happy With The Share price Today?

Eastern & Oriental Berhad (KLSE:E&O) shareholders should be happy to see the share price up 13% in the last quarter. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 71%. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for Eastern & Oriental Berhad

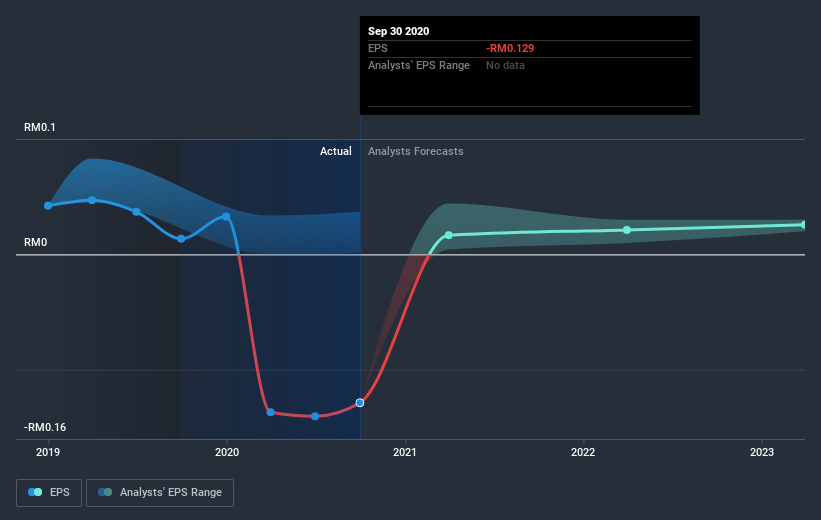

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Eastern & Oriental Berhad saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Eastern & Oriental Berhad's key metrics by checking this interactive graph of Eastern & Oriental Berhad's earnings, revenue and cash flow.

A Different Perspective

Eastern & Oriental Berhad shareholders are down 25% for the year (even including dividends), but the market itself is up 5.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Eastern & Oriental Berhad you should be aware of, and 1 of them can't be ignored.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Eastern & Oriental Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eastern & Oriental Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:E&O

Eastern & Oriental Berhad

An investment holding company, invests in, develops, manages, and sells residential and commercial properties in Malaysia and the United Kingdom.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives