- Malaysia

- /

- Real Estate

- /

- KLSE:SIMEPROP

Unpleasant Surprises Could Be In Store For Sime Darby Property Berhad's (KLSE:SIMEPROP) Shares

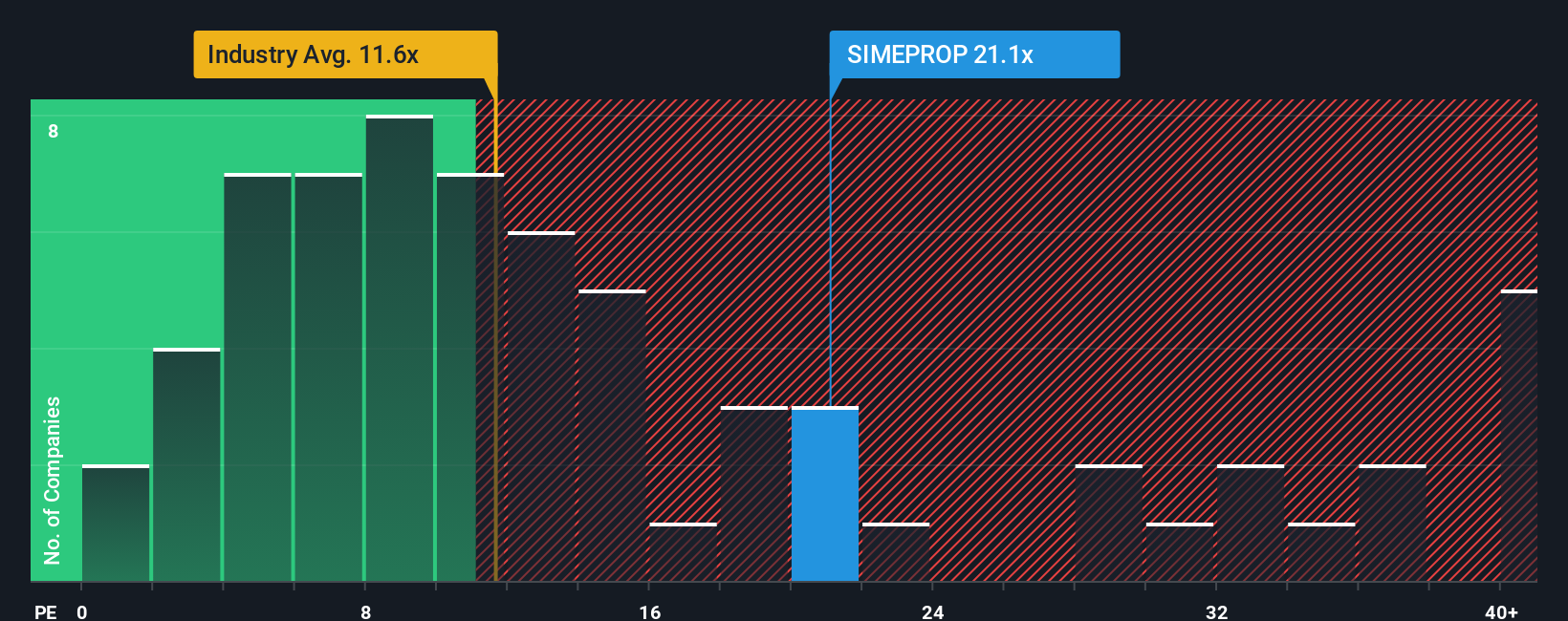

Sime Darby Property Berhad's (KLSE:SIMEPROP) price-to-earnings (or "P/E") ratio of 21.1x might make it look like a strong sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 13x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Sime Darby Property Berhad's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Sime Darby Property Berhad

Is There Enough Growth For Sime Darby Property Berhad?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Sime Darby Property Berhad's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.6% last year. The latest three year period has also seen an excellent 275% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 9.1% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 11% per year, which is noticeably more attractive.

With this information, we find it concerning that Sime Darby Property Berhad is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Sime Darby Property Berhad's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sime Darby Property Berhad's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Sime Darby Property Berhad with six simple checks on some of these key factors.

You might be able to find a better investment than Sime Darby Property Berhad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SIMEPROP

Sime Darby Property Berhad

An investment holding company, engages in the property development business in Malaysia, Singapore, and the United Kingdom.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.