- Malaysia

- /

- Real Estate

- /

- KLSE:RAPID

Despite lower earnings than five years ago, Rapid Synergy Berhad (KLSE:RAPID) investors are up 317% since then

The Rapid Synergy Berhad (KLSE:RAPID) share price has had a bad week, falling 13%. But over five years returns have been remarkably great. Indeed, the share price is up a whopping 317% in that time. So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

While the stock has fallen 13% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Rapid Synergy Berhad

Given that Rapid Synergy Berhad only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last half decade Rapid Synergy Berhad's revenue has actually been trending down at about 0.4% per year. This is in stark contrast to the strong share price growth of 33%, compound, per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

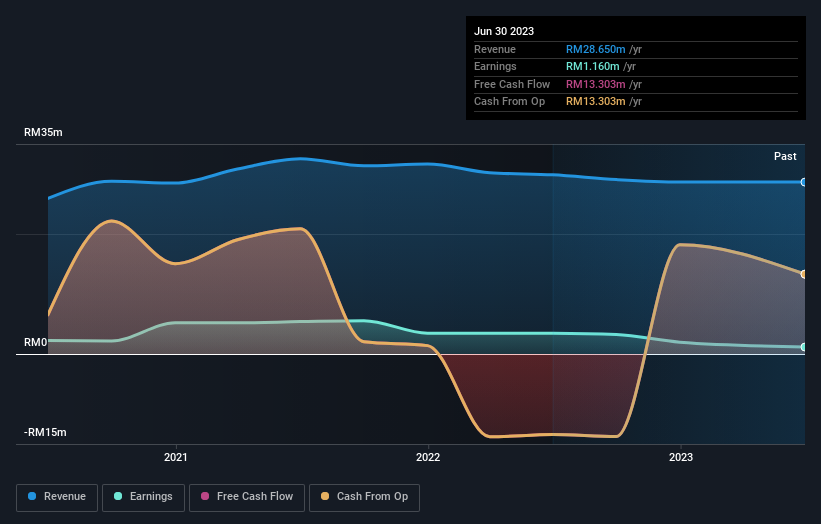

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Rapid Synergy Berhad stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Rapid Synergy Berhad has rewarded shareholders with a total shareholder return of 54% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 33% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Rapid Synergy Berhad (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

But note: Rapid Synergy Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RAPID

Rapid Synergy Berhad

An investment holding company, engages in manufacturing and sale of precision tools, dies, and molds for the semiconductor, electrical, and electronics industries in Malaysia, rest of Asia, and North Africa.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives