- Malaysia

- /

- Real Estate

- /

- KLSE:MUH

If EPS Growth Is Important To You, Multi-Usage Holdings Berhad (KLSE:MUH) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Multi-Usage Holdings Berhad (KLSE:MUH). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Multi-Usage Holdings Berhad

How Fast Is Multi-Usage Holdings Berhad Growing Its Earnings Per Share?

Multi-Usage Holdings Berhad has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Multi-Usage Holdings Berhad's EPS shot up from RM0.11 to RM0.17; a result that's bound to keep shareholders happy. That's a fantastic gain of 57%.

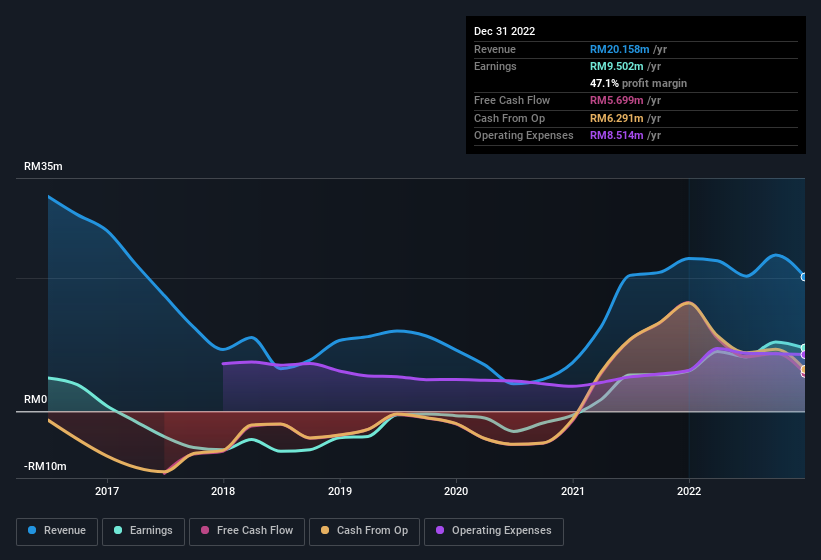

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. We note that while EBIT margins have improved from 35% to 57%, the company has actually reported a fall in revenue by 12%. While not disastrous, these figures could be better.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Multi-Usage Holdings Berhad is no giant, with a market capitalisation of RM28m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Multi-Usage Holdings Berhad Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Multi-Usage Holdings Berhad, with market caps under RM890m is around RM494k.

The CEO of Multi-Usage Holdings Berhad was paid just RM18k in total compensation for the year ending June 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Multi-Usage Holdings Berhad Worth Keeping An Eye On?

For growth investors, Multi-Usage Holdings Berhad's raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. However, before you get too excited we've discovered 3 warning signs for Multi-Usage Holdings Berhad (2 are concerning!) that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MUH

Multi-Usage Holdings Berhad

An investment holding company, engages in the property development activities in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion