- Malaysia

- /

- Real Estate

- /

- KLSE:IOIPG

Is Now The Time To Put IOI Properties Group Berhad (KLSE:IOIPG) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like IOI Properties Group Berhad (KLSE:IOIPG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide IOI Properties Group Berhad with the means to add long-term value to shareholders.

See our latest analysis for IOI Properties Group Berhad

How Quickly Is IOI Properties Group Berhad Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, IOI Properties Group Berhad has achieved impressive annual EPS growth of 40%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

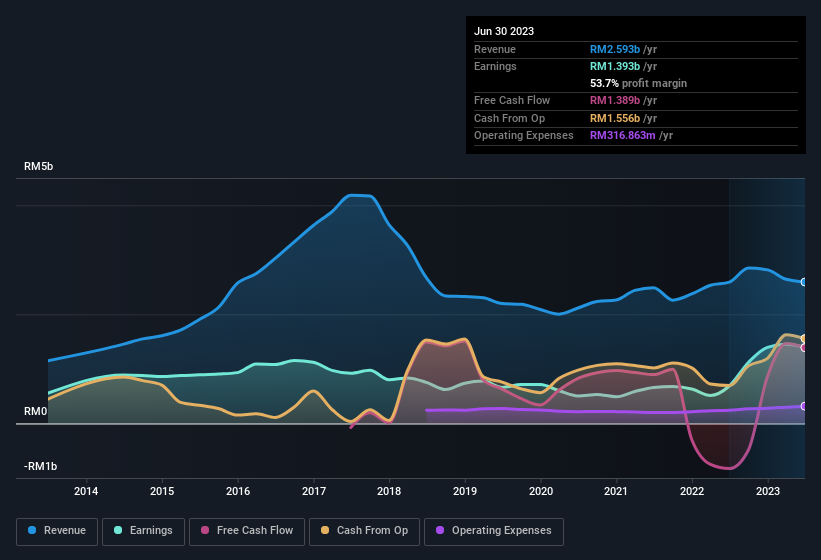

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes IOI Properties Group Berhad look pretty good, on balance; although revenue is flattish, EBIT margins improved from 36% to 49% in the last year. That's something to smile about.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for IOI Properties Group Berhad's future profits.

Are IOI Properties Group Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own IOI Properties Group Berhad shares worth a considerable sum. Given insiders own a significant chunk of shares, currently valued at RM360m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to IOI Properties Group Berhad, with market caps between RM4.7b and RM15b, is around RM2.6m.

The IOI Properties Group Berhad CEO received total compensation of only RM144k in the year to June 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is IOI Properties Group Berhad Worth Keeping An Eye On?

IOI Properties Group Berhad's earnings per share have been soaring, with growth rates sky high. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. IOI Properties Group Berhad is certainly doing some things right and is well worth investigating. We should say that we've discovered 3 warning signs for IOI Properties Group Berhad (2 can't be ignored!) that you should be aware of before investing here.

Although IOI Properties Group Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IOIPG

IOI Properties Group Berhad

An investment holding company, engages in the property development activities in Malaysia, Singapore, and the People's Republic of China.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success