- Malaysia

- /

- Real Estate

- /

- KLSE:HUAYANG

Increases to Hua Yang Berhad's (KLSE:HUAYANG) CEO Compensation Might Cool off for now

Key Insights

- Hua Yang Berhad will host its Annual General Meeting on 27th of August

- Salary of RM1.04m is part of CEO Wen Yan Ho's total remuneration

- The total compensation is 43% higher than the average for the industry

- Over the past three years, Hua Yang Berhad's EPS grew by 68% and over the past three years, the total shareholder return was 21%

Under the guidance of CEO Wen Yan Ho, Hua Yang Berhad (KLSE:HUAYANG) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 27th of August. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for Hua Yang Berhad

How Does Total Compensation For Wen Yan Ho Compare With Other Companies In The Industry?

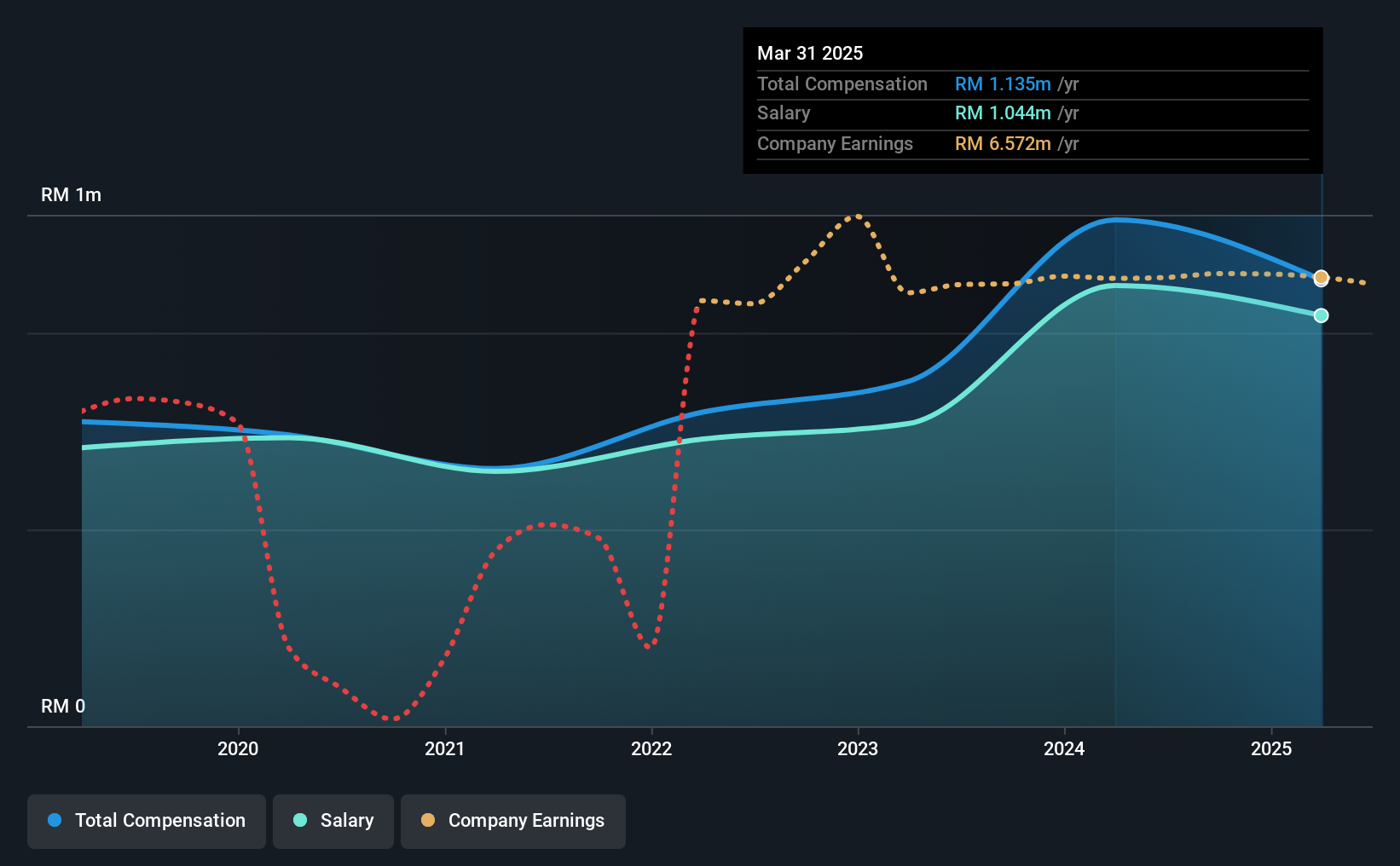

Our data indicates that Hua Yang Berhad has a market capitalization of RM101m, and total annual CEO compensation was reported as RM1.1m for the year to March 2025. Notably, that's a decrease of 12% over the year before. In particular, the salary of RM1.04m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Malaysian Real Estate industry with market capitalizations below RM845m, we found that the median total CEO compensation was RM792k. This suggests that Wen Yan Ho is paid more than the median for the industry. Moreover, Wen Yan Ho also holds RM519k worth of Hua Yang Berhad stock directly under their own name.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | RM1.0m | RM1.1m | 92% |

| Other | RM91k | RM167k | 8% |

| Total Compensation | RM1.1m | RM1.3m | 100% |

On an industry level, around 75% of total compensation represents salary and 25% is other remuneration. Hua Yang Berhad is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Hua Yang Berhad's Growth

Hua Yang Berhad's earnings per share (EPS) grew 68% per year over the last three years. Its revenue is down 52% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Hua Yang Berhad Been A Good Investment?

With a total shareholder return of 21% over three years, Hua Yang Berhad shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Hua Yang Berhad (1 is significant!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Hua Yang Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HUAYANG

Hua Yang Berhad

An investment holding company, engages in the property development business in Malaysia.

Acceptable track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026