- Malaysia

- /

- Real Estate

- /

- KLSE:EWINT

Eco World International Berhad (KLSE:EWINT) shareholders are still up 68% over 5 years despite pulling back 13% in the past week

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more -- or less -- than that. The Eco World International Berhad (KLSE:EWINT) stock price is down 43% over five years, but the total shareholder return is 68% once you include the dividend. And that total return actually beats the market return of 25%. And the share price decline continued over the last week, dropping some 13%.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Eco World International Berhad

Eco World International Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last five years Eco World International Berhad saw its revenue shrink by 8.2% per year. While far from catastrophic that is not good. The share price decline at a rate of 7% per year is disappointing. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. Without profits, its hard to see how shareholders win if the revenue keeps falling.

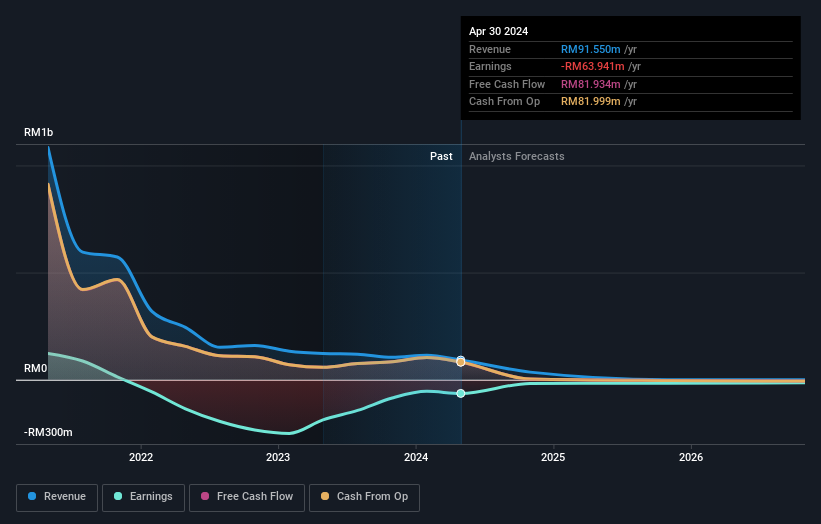

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Eco World International Berhad's TSR for the last 5 years was 68%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Eco World International Berhad shareholders have received a total shareholder return of 65% over one year. That's including the dividend. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Eco World International Berhad better, we need to consider many other factors. For example, we've discovered 2 warning signs for Eco World International Berhad (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

But note: Eco World International Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

If you're looking to trade Eco World International Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eco World International Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:EWINT

Eco World International Berhad

An investment holding company, engages in the property development business in the United Kingdom, Australia, and Malaysia.

Flawless balance sheet moderate.

Market Insights

Community Narratives