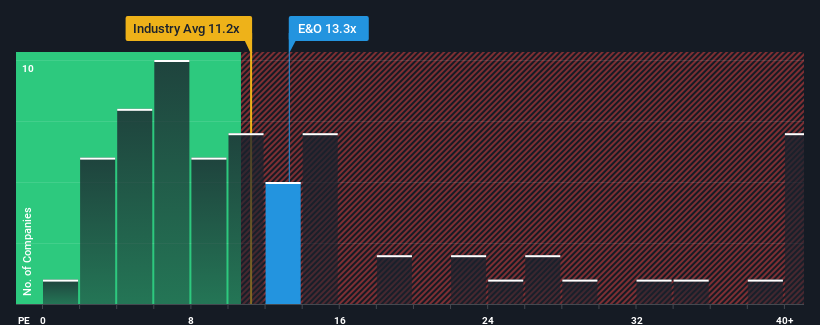

With a median price-to-earnings (or "P/E") ratio of close to 14x in Malaysia, you could be forgiven for feeling indifferent about Eastern & Oriental Berhad's (KLSE:E&O) P/E ratio of 13.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Eastern & Oriental Berhad could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Eastern & Oriental Berhad

Does Growth Match The P/E?

Eastern & Oriental Berhad's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.2%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 53% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 15% growth forecast for the broader market.

In light of this, it's curious that Eastern & Oriental Berhad's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Eastern & Oriental Berhad's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Eastern & Oriental Berhad (1 can't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Eastern & Oriental Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Eastern & Oriental Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:E&O

Eastern & Oriental Berhad

An investment holding company, invests in, develops, manages, and sells residential and commercial properties in Malaysia and the United Kingdom.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives