- Malaysia

- /

- Real Estate

- /

- KLSE:E&O

Eastern & Oriental Berhad's (KLSE:E&O) Price Is Right But Growth Is Lacking After Shares Rocket 25%

Eastern & Oriental Berhad (KLSE:E&O) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 68% in the last year.

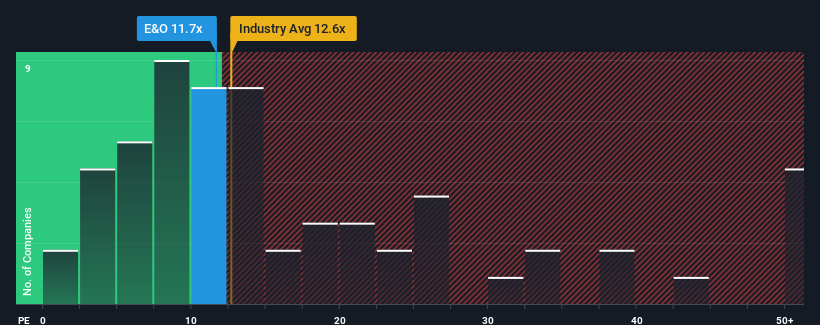

Even after such a large jump in price, Eastern & Oriental Berhad's price-to-earnings (or "P/E") ratio of 11.7x might still make it look like a buy right now compared to the market in Malaysia, where around half of the companies have P/E ratios above 16x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Eastern & Oriental Berhad has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Eastern & Oriental Berhad

Does Growth Match The Low P/E?

Eastern & Oriental Berhad's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 22% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 5.9% per annum over the next three years. That's not great when the rest of the market is expected to grow by 13% each year.

With this information, we are not surprised that Eastern & Oriental Berhad is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Eastern & Oriental Berhad's P/E?

Eastern & Oriental Berhad's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Eastern & Oriental Berhad's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Eastern & Oriental Berhad (2 are concerning) you should be aware of.

If these risks are making you reconsider your opinion on Eastern & Oriental Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Eastern & Oriental Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:E&O

Eastern & Oriental Berhad

An investment holding company, invests in, develops, manages, and sells residential and commercial properties in Malaysia and the United Kingdom.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives