Income Investors Should Know That Y.S.P. Southeast Asia Holding Berhad (KLSE:YSPSAH) Goes Ex-Dividend Soon

Y.S.P. Southeast Asia Holding Berhad (KLSE:YSPSAH) stock is about to trade ex-dividend in three days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, Y.S.P. Southeast Asia Holding Berhad investors that purchase the stock on or after the 12th of December will not receive the dividend, which will be paid on the 12th of January.

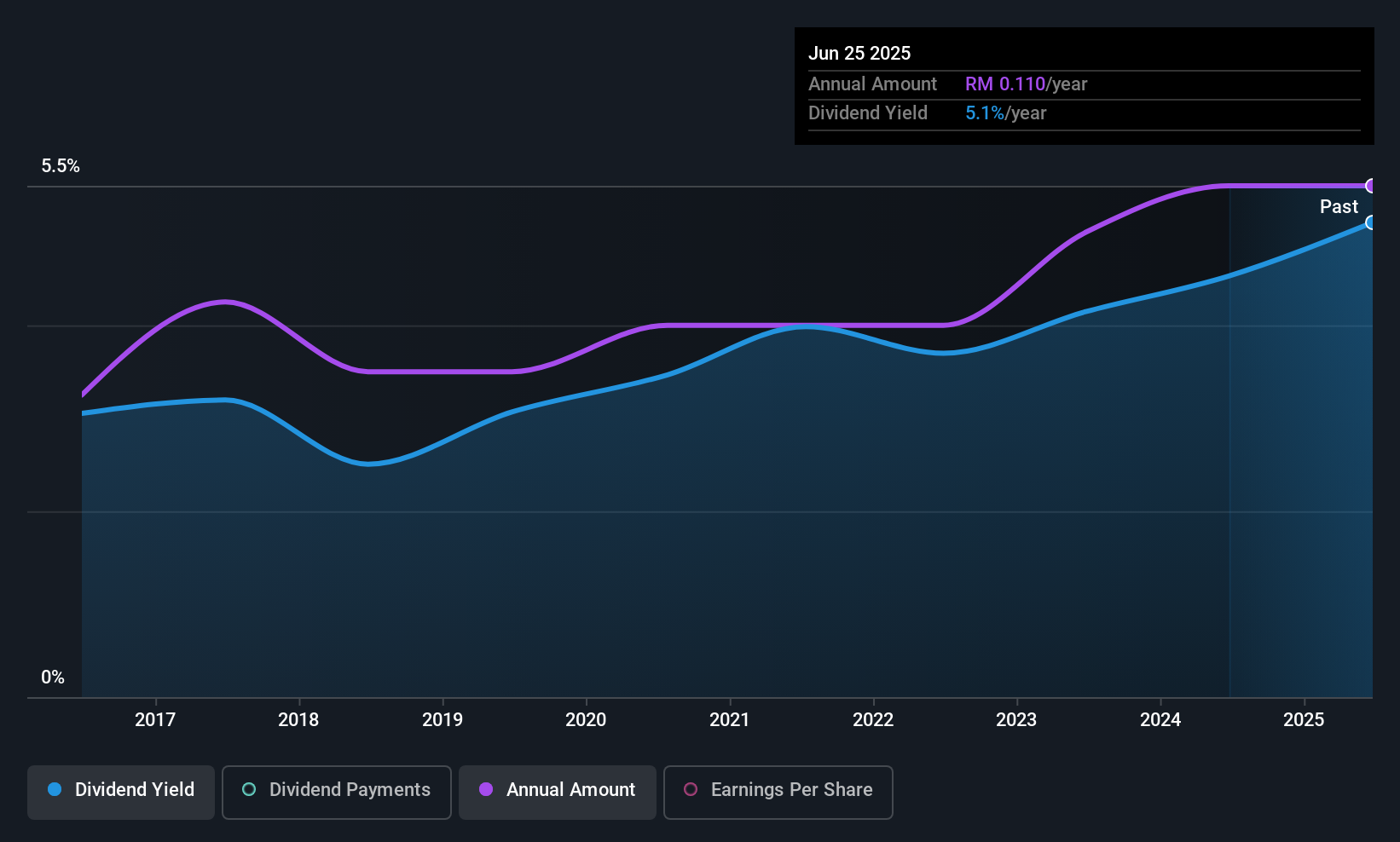

The company's next dividend payment will be RM00.04 per share. Last year, in total, the company distributed RM0.08 to shareholders. Calculating the last year's worth of payments shows that Y.S.P. Southeast Asia Holding Berhad has a trailing yield of 3.8% on the current share price of RM02.10. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Y.S.P. Southeast Asia Holding Berhad can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. It paid out 88% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. It could become a concern if earnings started to decline. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Thankfully its dividend payments took up just 32% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that Y.S.P. Southeast Asia Holding Berhad's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

View our latest analysis for Y.S.P. Southeast Asia Holding Berhad

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's not encouraging to see that Y.S.P. Southeast Asia Holding Berhad's earnings are effectively flat over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run. A payout ratio of 88% looks like a tacit signal from management that reinvestment opportunities in the business are low. In line with limited earnings growth in recent years, this is not the most appealing combination.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Y.S.P. Southeast Asia Holding Berhad has delivered an average of 2.1% per year annual increase in its dividend, based on the past 10 years of dividend payments.

To Sum It Up

From a dividend perspective, should investors buy or avoid Y.S.P. Southeast Asia Holding Berhad? Earnings per share have been flat and Y.S.P. Southeast Asia Holding Berhad's dividend payouts are within reasonable limits; without a sharp decline in earnings we feel that the dividend is likely somewhat sustainable. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

While it's tempting to invest in Y.S.P. Southeast Asia Holding Berhad for the dividends alone, you should always be mindful of the risks involved. For example, we've found 2 warning signs for Y.S.P. Southeast Asia Holding Berhad that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YSPSAH

Y.S.P. Southeast Asia Holding Berhad

Engages in the manufacturing and trading of generic drugs in Malaysia, Singapore, Vietnam, Philippines, Cambodia, Myanmar, Brunei, Indonesia, Thailand, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026