Could Star Media Group Berhad (KLSE:STAR) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

A high yield and a long history of paying dividends is an appealing combination for Star Media Group Berhad. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Star Media Group Berhad!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Star Media Group Berhad paid out 260% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Of the free cash flow it generated last year, Star Media Group Berhad paid out 25% as dividends, suggesting the dividend is affordable. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Star Media Group Berhad fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

With a strong net cash balance, Star Media Group Berhad investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on Star Media Group Berhad's financial position here.

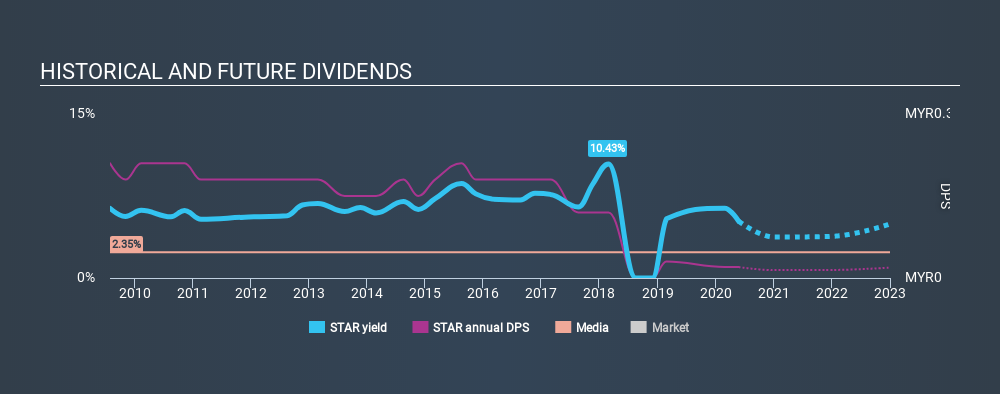

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of Star Media Group Berhad's dividend payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past ten-year period, the first annual payment was RM0.21 in 2010, compared to RM0.02 last year. Dividend payments have fallen sharply, down 90% over that time.

A shrinking dividend over a ten-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Star Media Group Berhad's EPS have fallen by approximately 45% per year during the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Star Media Group Berhad's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that Star Media Group Berhad's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. With this information in mind, we think Star Media Group Berhad may not be an ideal dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for Star Media Group Berhad (of which 2 are potentially serious!) you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:STAR

Star Media Group Berhad

Operates as an integrated media company in Malaysia, the United States, Singapore, Ireland, the United Kingdom, Indonesia, Dubai, and internationally.

Flawless balance sheet with solid track record.