- Malaysia

- /

- Metals and Mining

- /

- KLSE:ASTEEL

YKGI Holdings Berhad's (KLSE:YKGI) Solid Profits Have Weak Fundamentals

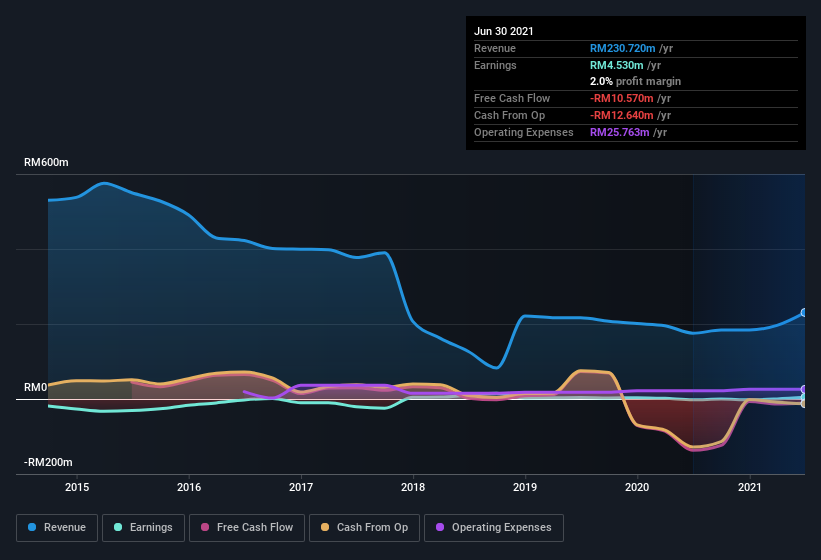

YKGI Holdings Berhad (KLSE:YKGI) just reported some strong earnings, and the market rewarded them with a positive share price move. We did some analysis and think that investors are missing some details hidden beneath the profit numbers.

Check out our latest analysis for YKGI Holdings Berhad

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, YKGI Holdings Berhad issued 22% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of YKGI Holdings Berhad's EPS by clicking here.

How Is Dilution Impacting YKGI Holdings Berhad's Earnings Per Share? (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if YKGI Holdings Berhad's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of YKGI Holdings Berhad.

Our Take On YKGI Holdings Berhad's Profit Performance

YKGI Holdings Berhad issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that YKGI Holdings Berhad's statutory profits are better than its underlying earnings power. The good news is that it earned a profit in the last twelve months, despite its previous loss. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we've spotted 4 warning signs for YKGI Holdings Berhad (of which 1 is significant!) you should know about.

This note has only looked at a single factor that sheds light on the nature of YKGI Holdings Berhad's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ASTEEL

ASTEEL Group Berhad

Manufactures and sells galvanized and coated steel products in Malaysia and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives